Contents

Electronic Identification

Electronic identification is a cornerstone of the European Digital Single Market. Under the eIDAS Regulation, it enables secure, interoperable, and legally recognised identification of natural and legal persons across borders. For obliged entities, public authorities, and regulated industries, electronic identification forms the technical and legal foundation for digital onboarding, access control, and compliance-relevant processes such as KYC and AML.

Overview of Electronic Identification Attributes

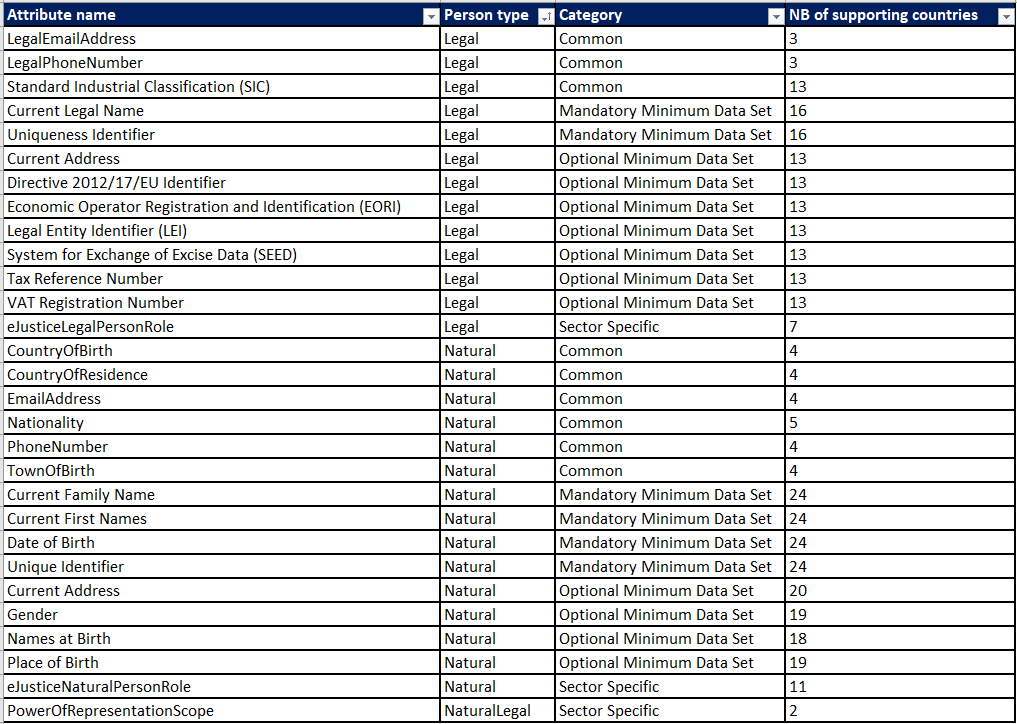

The table on this page provides a structured overview of electronic identification attributes as used within the EU Digital Identity and eIDAS framework. It illustrates how digital identity is built from individual, verifiable data elements rather than from a single monolithic identity record.

The table distinguishes in particular between:

- Natural persons and legal persons, reflecting the different legal and regulatory identity models applicable to individuals and organisations.

- Mandatory minimum data sets, which constitute the core attributes required for basic electronic identification.

- Optional minimum data sets, which may be required depending on the specific use case, legal obligation, or sectoral regulation.

- Common and sector-specific attributes, highlighting that electronic identification must be extensible to support regulated use cases such as financial services, justice, or corporate representation.

This structured attribute-based approach reflects the design principles of the eIDAS Regulation and the European Digital Identity Wallet: identity data must be purpose-bound, selectively disclosable, and anchored in authoritative sources. The table therefore provides transparency on which attributes are available, which are mandatory, and which are context-dependent for cross-border electronic identification.

eIDAS Network

The eIDAS Network is the technical and organisational backbone enabling cross-border electronic identification within the European Union. It consists of interconnected eIDAS Nodes, with one node operated by each participating country.

Each Member State is responsible for:

- implementing and operating its national eIDAS Node, and

- connecting national Identity Providers and Attribute Providers to that node, thereby making national electronic identification schemes available to cross-border online services.

Through this network, a relying party in one Member State can securely authenticate a user identified under another Member State’s national eID scheme. The eIDAS Network therefore ensures mutual recognition, interoperability, and legal certainty for electronic identification across the EU.

The legal basis for cooperation within the eIDAS Network is laid down in Commission Implementing Decision (EU) 2015/296, which requires each Member State to designate a single point of contact for electronic identification cooperation. This mechanism simplifies coordination, ensures accountability, and supports the operational functioning of cross-border identification services.

The European Commission, supported by the DIGITAL Programme, provides tools and public information that visualise the interconnections between national eIDAS Nodes and publish metadata on supported attributes, technical contacts, and operational capabilities. This transparency is essential for service providers, regulators, and obliged entities relying on electronic identification in regulated environments.

https://eidas.ec.europa.eu/efda/browse/notification/eid-chapter-contacts

Electronic Identification as a Compliance Enabler

In regulated sectors such as financial services, electronic identification under eIDAS is not merely a technical convenience. It is a compliance-enabling infrastructure that supports legally reliable onboarding, identity verification, and cross-border digital services. While electronic identification provides the verified identity foundation, additional regulatory obligations – such as AML and KYC requirements -build on top of this framework using further data, controls, and risk-based measures.