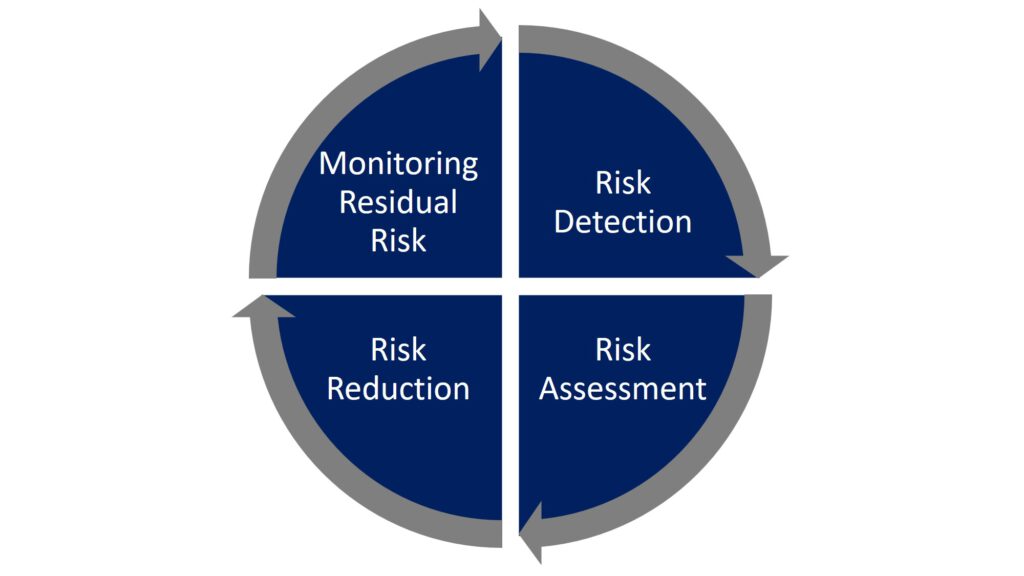

Risk Management Process

The German GwG sets out a comprehensive Risk Management Process aimed at preventing money laundering and terrorist financing. This process includes steps for Risk Detection, Risk Assessment, Risk Reduction, and the Monitoring of Residual Risk.

The GwG emphasizes the importance of EDD across various high-risk scenarios:

- PEPs/RCAs: EDD is crucial when dealing with individuals holding significant public positions or their close associates, requiring rigorous identity verification, understanding their source of wealth, and ongoing monitoring to mitigate potential risks of money laundering.

- High-Risk Third Countries: Transactions linked to countries identified as high risk for financial crimes necessitate additional scrutiny. Institutions must gather extensive information about the parties involved and closely monitor these transactions to prevent illicit financial flows.

- High-Risk Transactions: Certain transactions, characterized by their complexity, size, or lack of transparency, trigger EDD measures. These include a thorough examination of the transaction’s purpose and background, coupled with enhanced monitoring to detect and prevent financial crimes.

- Cross-Border Correspondent Relationships: In correspondent banking, especially with institutions in third countries, EDD involves assessing the respondent bank’s controls against money laundering, obtaining senior management approval, and ensuring compliance with regulatory standards to safeguard against financial risks.

Obliged entities must adeptly navigate the Risk Management Process, implementing strategies that encompass Risk Detection, Risk Assessment, Risk Reduction, and the Monitoring of Residual Risk. This comprehensive approach ensures not only adherence to regulatory requirements but also fortifies the financial system against potential threats.

By prioritizing EDD in high-risk scenarios, obliged entities reinforce their defenses against money laundering and terrorist financing. The GwG’s structured framework serves as a beacon for managing financial risks, ensuring the integrity and stability of financial transactions in today’s globalized economy.

Risk Detection

PEP/RCA

Risk Detection involves identifying whether a contracting party or beneficial owner is a PEP, a family member of a PEP, or a person known to be a close associate. This step is crucial as it triggers the need for enhanced due diligence if a potential risk is identified. It relies on appropriate, risk-oriented procedures to ensure that entities subject to the GwG are aware of the risks posed by their clients or partners from the outset of the business relationship.

High-Risk Third Country

Risk Detection involves the initial identification and verification of the contracting party and, if applicable, the beneficial owner before establishing a business relationship or executing a transaction. This process includes collecting essential information such as names, addresses, birth dates, nationalities, and other relevant details for natural persons, as well as registration details and ownership structures for legal entities. This step is crucial for detecting any potential risks early in the process, particularly for transactions involving parties from third countries not part of the EU or EEA, as defined in the GwG.

High-Risk Transactions

Risk Detection involves continuous monitoring of business relationships and the transactions within these relationships. This monitoring is aimed at ensuring transactions align with the known information about the contracting party, beneficial owner, their business activities, customer profile, and the source of their wealth. This stage is critical for early identification of discrepancies or anomalies that might suggest a higher risk of money laundering or terrorist financing.

Cross-Border Correspondent Relationships

Risk Detection in the context of cross-border correspondent relationships involves identifying situations where an obliged entity, such as a bank, enters into a business relationship with respondents from third countries or the European Economic Area (EEA) that might pose a heightened risk. This step is critical for early identification and management of potential money laundering or terrorist financing risks.

Risk Assessment

PEP/RCA

Risk Assessment is defined through the detailed descriptions of PEPs, their family members, and close associates within the GwG. This includes a wide range of high-ranking positions and relationships that could expose financial transactions to higher risks of money laundering. The assessment phase involves evaluating the extent of risk associated with a PEP, considering their position, the political environment, and the nature of the transaction or business relationship.

High-Risk Third Country

Risk Assessment involves evaluating the potential risks associated with a third country, taking into account factors such as the country’s legal and regulatory framework, the prevalence of money laundering and terrorist financing activities, and the effectiveness of its measures against such activities. This assessment helps in understanding the level of risk a third country might pose and guides the subsequent risk management steps.

High-Risk Transactions

Risk Assessment comes into play when transactions exhibit characteristics that deviate from the norm, such as being unusually complex, large, following an unusual pattern, or lacking an apparent economic or lawful purpose. These characteristics trigger a need for a more in-depth analysis to understand the nature and purpose of the transaction and to evaluate the associated risks of money laundering and terrorist financing.

Cross-Border Correspondent Relationships

Risk Assessment in these relationships requires understanding the nature of the services provided, including current or payment account services, cash management, international fund transfers, foreign exchange transactions, and cheque clearing. The assessment must consider the legal and regulatory environment of the respondent’s country, the respondent’s business practices, and the potential for money laundering or terrorist financing within that context.

Risk Reduction

PEP/RCA

Risk Reduction involves taking adequate measures to mitigate identified risks. When a PEP, their family member, or a close associate is involved, the GwG mandates specific enhanced due diligence requirements, including obtaining approval from senior management to establish or continue a business relationship and taking adequate measures to establish the source of funds involved. These steps are designed to reduce the risk of engaging in a business relationship that could facilitate money laundering or terrorist financing.

High-Risk Third Country

In cases where transactions involve high-risk third countries, the GwG mandates specific enhanced due diligence requirements. Obliged entities must obtain additional information regarding the contracting party, the beneficial owner, the intended nature of the business relationship, and the source of assets and wealth involved in the transaction. Additionally, establishing or continuing such business relationships requires approval from a member of senior management, ensuring a higher level of scrutiny and oversight for transactions deemed high-risk.

High-Risk Transactions

Upon identifying a high-risk transaction, obliged entities are required to conduct a thorough examination of the transaction and its background. This involves taking appropriate measures to assess the risk associated with the business relationship or transaction in question. The aim is to understand the transaction’s purpose fully, its alignment with the customer’s profile, and to determine if there’s a need to report the transaction to the Financial Intelligence Unit (FIU).

Cross-Border Correspondent Relationships

To mitigate the identified risks, the GwG mandates several EDD measures for financial institutions engaging in correspondent relationships:

- Understanding the Respondent: Institutions must gather comprehensive information about the respondent to fully grasp their business nature, reputation, AML controls, and the quality of regulatory oversight they are subject to.

- Senior Management Approval: Establishing any new correspondent relationship requires prior approval from senior management, ensuring an additional layer of scrutiny.

- Documenting Responsibilities: The roles and responsibilities related to fulfilling due diligence requirements must be clearly documented before establishing the relationship.

- Shell Bank Prohibition: Institutions must ensure that they do not engage with respondents known to use shell banks.

- Payable-Through Accounts: Measures must be in place to prevent the respondent from permitting transactions through payable-through accounts, which could obscure the true originator or beneficiary of the funds.

Monitoring Residual Risk

PEP/RCA

Monitoring Residual Risk involves conducting enhanced, ongoing monitoring of the business relationship. This continuous scrutiny is crucial to detect any unusual or suspicious activities that may arise during the course of the relationship. It ensures that any residual risk, not mitigated by the initial risk reduction measures, is managed effectively and that the entity remains compliant with AML/CTF regulations.

High-Risk Third Country

Even after implementing risk reduction measures, there’s a need for ongoing vigilance. The GwG requires enhanced, continuous monitoring of the business relationship to detect any suspicious activities that may arise over time. This includes increasing the number and timing of controls and selecting specific transaction patterns for further examination, ensuring that any residual risks are effectively managed.

High-Risk Transactions

Even after implementing risk reduction measures, there’s a need for enhanced, ongoing monitoring of the business relationship and the transactions therein. This continuous monitoring is essential to reassess the risks associated with the business relationship and individual transactions, ensuring that any residual risk related to money laundering and terrorist financing is effectively managed.

Cross-Border Correspondent Relationships

The monitoring of residual risk is integrated within the risk reduction measures. Continuous monitoring and re-evaluation of the correspondent relationship are essential to ensure ongoing compliance and to adapt to any changes in the respondent’s risk profile or the broader regulatory landscape.

Source:

- BaFin-Conference on the prevention of money laundering and terrorist financing https://www.bafin.de/SharedDocs/Veranstaltungen/DE/2023_12_07_Geldwaeschebekaempfung.html