AML & CTF System

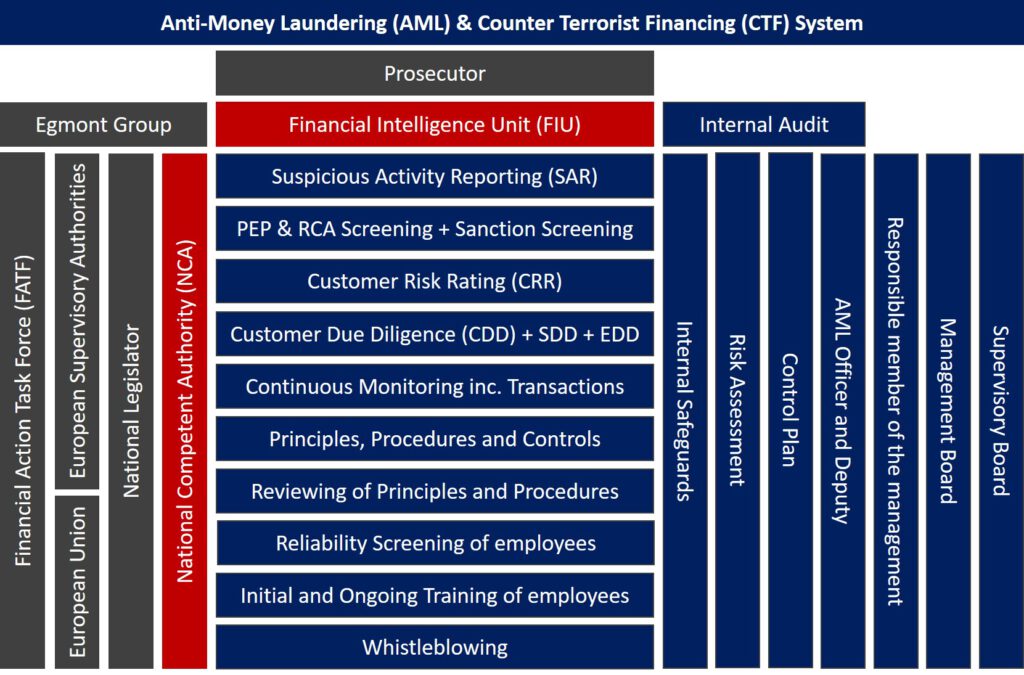

Anti-Money Laundering (AML) and Counter Terrorist Financing (CTF) Systems (AML & CTF Systems) stand as a critical pillar in safeguarding the integrity of the financial sector. As depicted in a detailed organizational chart, the AML & CTF System is a multidimensional framework that integrates risk management, compliance measures, and internal governance.

Risk Management as the Foundation of AML & CTF Systems

Risk Management is not just a requirement but the very bedrock of an effective AML & CTF system. It mandates the establishment of effective risk management systems that are commensurate with the nature and size of the business. This entails the appointment of a dedicated member of the management team to oversee risk management, ensuring compliance with the stringent provisions of AML and CTF laws.

Risk Assessment: A Tailored Approach

A nuanced approach to Risk Assessment is central to the system. To conduct thorough Risk Assessment tailored to their specific business activities, paying close attention to the factors listed in the National Risk Assessment. The degree of analysis is directly proportional to the entity’s size and the complexity of its operations, ensuring a tailored risk assessment process.

Internal Controls and Safeguards: The Pillars of Compliance

Internal Controls and Safeguards are not just principles but actionable measures, including the continuous monitoring of transactions and the implementation of customer due diligence (CDD), both standard and enhanced (EDD). Having Internal Principles, Procedures, and Controls in place, reviewed by an independent audit to ensure their effectiveness, is key.

A Visual Depiction of the AML & CTF Ecosystem

The AML & CTF System image succinctly captures the ecosystem’s breadth, highlighting the synchronized operation of various components. From the role of international bodies such as the Financial Action Task Force (FATF) and the Egmont Group to the operational steps outlined for compliance, such as Suspicious Activity Reporting (SAR) and the development of internal principles and controls, the visual aid underscores the need for a robust compliance structure.

Training and Continuous Improvement

Moreover, the system recognizes the value of human capital by mandating initial and ongoing training for employees, ensuring that they are always abreast of the latest typologies in money laundering and terrorist financing. This commitment to continuous improvement is a testament to the dynamic nature of AML & CTF systems.

Whistleblowing: Ensuring Confidentiality and Integrity

Whistleblowing mechanisms, as highlighted in the diagram, provide a confidential avenue for employees to report any contraventions of AML and CTF laws. This is a clear nod to the emphasis on integrity and transparency within the system.

Embracing a Holistic AML & CTF Framework

In conclusion, the AML & CTF System, as visualized, offers a comprehensive blueprint for obliged entities to prevent money laundering and terrorist financing. By encompassing risk assessments and internal controls and safeguards, the system promotes a holistic and proactive approach to financial compliance. For any financial institution keen on maintaining the highest standards of regulatory compliance, understanding and implementing the facets of this system is not just a regulatory mandate but a strategic imperative in today’s global economy.