Contents

- Money Laundering

- 3 Stages of Money Laundering

- Vienna Convention

- Council Directive 91/308/EEC

- Directive 2001/97/EC

- Directive 2005/60/EC

- Directive (EU) 2015/849

- Directive (EU) 2018/1673

- German German Criminal Code

- Criminalization of Money Laundering Acts

- Concealment or Obscuration of Relevant Facts

- Attempted Offenses

- Increased Penalties for Obligated Parties

- Penalties in Particularly Severe Cases

- Negligent Failure to Recognize

- Predicate Offense Participation

- Exemption from Punishment

- Equivalent Objects from Abroad

- Seizure of Objects

Money Laundering

Money laundering is a critical issue that affects both financial systems and societal structures globally. It involves the process of making illegally-gained proceeds (i.e., „dirty money“) appear legal (i.e., „clean“). The process of money laundering is a key operation of the criminal world, allowing criminals to enjoy profits without attracting attention from law enforcement and regulators. This comprehensive overview delves into the concept of money laundering, with a focus on its definitions and regulations as per the Vienna Convention, the European Union, and German law.

The United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, also known as the Vienna Convention, was adopted in 1988. It represents a significant step in international efforts to combat drug trafficking and its related financial operations, including money laundering.

Under the Vienna Convention, money laundering is addressed primarily in the context of drug-related crimes. The Convention mandates that member states establish as criminal offenses various acts related to the illicit trafficking of narcotic drugs and psychotropic substances, as well as the laundering of proceeds from such activities.

The European Union (EU) has been proactive in legislating against money laundering, evolving its legal framework over the years through several directives.

- Council Directive 91/308/EEC:

- This was the first EU directive addressing money laundering. It defined money laundering in terms of drug offenses and imposed obligations on the financial sector to prevent the misuse of the financial system for the purpose of money laundering.

- Directive 2001/97/EC:

- This directive expanded the scope of the 91/308/EEC Directive, both in terms of the crimes covered and the range of professions and activities subjected to anti-money laundering regulations. It included a broader array of predicate offenses beyond drug-related crimes.

- Directive 2005/60/EC:

- Known as the Third Money Laundering Directive, it incorporated the FATF’s (Financial Action Task Force) recommendations and extended its scope to include measures against terrorist financing. It emphasized due diligence and the identification of beneficial owners.

- Directive (EU) 2018/1673:

- This directive further broadened the definition of money laundering and enhanced cooperation between member states. It emphasized the need for consistent punitive measures across the EU and addressed the risks of emerging technologies in money laundering schemes.

Germany, as an EU member state, aligns its national laws with EU directives. Section 261 of the German Criminal Code (Strafgesetzbuch – StGB) is dedicated to money laundering. It defines money laundering and prescribes penalties for various related offenses. In German law, money laundering is not only seen as a financial crime but also as a threat to the integrity of financial markets and public trust in financial institutions. Therefore, the law emphasizes both preventive measures and punitive actions.

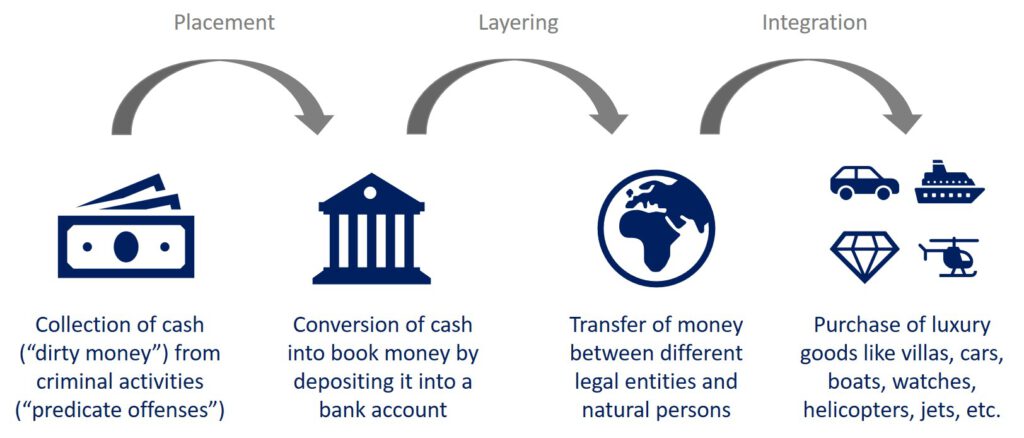

3 Stages of Money Laundering

Money laundering is a process that follows at least three stages to finally release laundered funds into the legal financial system.

Placement

- This is the initial stage where illicit funds are introduced into the financial system. Criminals look for ways to deposit, transfer, or otherwise move the illicit money away from direct association with the underlying crime. This could involve bank deposits, purchasing of assets, or other methods to get the illegal earnings into the financial system without attracting attention.

Layering

- The purpose of this stage is to conceal the origin of the money through a series of complex transactions and bookkeeping tricks. This often involves moving the money through various accounts (often in different countries), changing its form, or investing it in other ventures. The aim is to make tracing the original source of the funds as difficult as possible, thereby disconnecting the illicit money from the criminal activity.

Integration

- In the final stage, the ‚cleaned‘ money is reintegrated into the economy in such a way that it appears to be legitimate business earnings. This can be achieved through investments in legal businesses, luxury purchases, or other means that allow the criminal to use the funds without raising suspicion.

Vienna Convention

The Vienna Convention (United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1988) in its Article 3, outlines a comprehensive framework for criminalizing various activities related to narcotic drugs and psychotropic substances. Here’s a summary:

Establishment of Criminal Offences

- Parties to the Convention are required to establish as criminal offences under their domestic law the following activities, when committed intentionally:

Narcotic Drugs and Psychotropic Substances Related Offences

- Illegal activities involving narcotic drugs or psychotropic substances, including their production, manufacture, sale, transport, importation, and exportation, in violation of the 1961 Convention and its amendments, or the 1971 Convention.

- Unlawful cultivation of opium poppy, coca bush, or cannabis plant for narcotic drug production, contrary to the 1961 Convention and its amendments.

- Possession or purchase of any narcotic drug or psychotropic substance with the intent to engage in the activities outlined in i).

- Manufacturing, transporting, or distributing equipment or materials known to be used for the illicit cultivation or production of narcotic drugs or psychotropic substances.

- Organizing, managing, or financing any of the offences mentioned above.

Money Laundering Offences

- The conversion or transfer of property known to be derived from offences listed in subsection a), for the purpose of concealing the illicit origin of the property or assisting anyone involved in such offences to evade legal consequences.

- Concealment or disguise of the nature, source, location, or ownership of property known to be derived from offences listed before.

Council Directive 91/308/EEC

The Directive on prevention of the use of the financial system for the purpose of money laundering (Council Directive 91/308/EEC) defines „money laundering“ in Article 1 with several key components, emphasizing the intentional nature of the act.

Definition of Money Laundering

The directive categorizes money laundering as an intentional act and outlines several forms:

- Conversion or Transfer of Property: This involves converting or transferring property, knowing it comes from criminal activities, to hide its illegal origin or help someone involved in the crime avoid legal consequences.

- Concealment or Disguise: This refers to hiding or disguising the nature, source, location, movement, or ownership of property known to be derived from criminal activities.

- Acquisition, Possession, or Use of Property: This involves acquiring, possessing, or using property that is known to have been derived from criminal activities at the time of receipt.

- Participation and Association: This includes participating in, attempting, aiding, abetting, facilitating, and counseling the commission of any of the above actions.

Inference of Knowledge, Intent, or Purpose

- The directive acknowledges that knowledge, intent, or purpose involved in these activities can be inferred from objective factual circumstances, suggesting that direct evidence of intent is not always necessary for a conviction.

Scope Beyond Local Jurisdiction

- It is also specified that money laundering is considered as such even if the activities generating the laundered property occurred in another Member State or a third country, indicating the directive’s broad geographical scope.

Directive 2001/97/EC

The Directive amending Council Directive 91/308/EEC on prevention of the use of the financial system for the purpose of money laundering (Directive 2001/97/EC) introduced modifications to the original Directive.

Revised Definition of Money Laundering

The amendments maintain the core aspects of the original definition of money laundering but present it with updated wording and structure:

- Conversion or Transfer of Property: It reiterates that converting or transferring property known to be derived from criminal activity, with the intent to conceal its illicit origin or assist someone involved in the crime, constitutes money laundering.

- Concealment or Disguise: The concealment or disguise of the nature, source, location, movement, or ownership of property known to be from criminal activity remains a form of money laundering.

- Acquisition, Possession, or Use of Property: Acquiring, possessing, or using property with the knowledge that it was derived from criminal activity is included under money laundering activities.

- Participation and Association: Engaging in, associating with, attempting, aiding, abetting, facilitating, or counseling the commission of any of the aforementioned actions is considered money laundering.

Inference of Knowledge, Intent, or Purpose

- The amendment retains the provision that knowledge, intent, or purpose involved in money laundering can be inferred from objective factual circumstances, thus not always requiring direct evidence of intent for a conviction.

Geographical Scope

- The amended directive continues to state that money laundering is considered as such even if the criminal activities generating the property occurred in another Member State or a third country, emphasizing its broad geographical reach.

Directive 2005/60/EC

The Directive on the prevention of the use of the financial system for the purpose of money laundering and terrorist financing (Directive 2005/60/EC) elaborates on the definition of money laundering in Article 1.

Intentional Conduct Constituting Money Laundering

The directive specifies certain actions as money laundering when done intentionally:

- Conversion or Transfer of Property: This includes converting or transferring property, knowing it is derived from criminal activity, to conceal its illicit origin or to assist anyone involved in the crime to evade legal consequences.

- Concealment or Disguise: It covers concealing or disguising the true nature, source, location, disposition, movement, rights with respect to, or ownership of property, knowing that it is derived from criminal activity.

- Acquisition, Possession, or Use of Property: This refers to acquiring, possessing, or using property, with the knowledge at the time of receipt that it was derived from criminal activity.

- Participation and Association: It includes participation in, association to commit, attempts to commit, and aiding, abetting, facilitating, and counseling the commission of any of the actions mentioned above.

Geographical Scope

- The directive asserts that money laundering is considered as such regardless of whether the activities generating the property to be laundered were carried out in the territory of another Member State or a third country. This expands the scope of the law beyond the borders of one’s own country.

Directive (EU) 2015/849

Recital (3) of the 4th Anti-Money Laundering Directive (AMLD) (Directive (EU) 2015/849) provides an overview of the evolution of the European Union’s legislative framework against money laundering and terrorist financing. Here’s a summary:

Historical Evolution of EU Directives on Money Laundering

- Initial Directive (Council Directive 91/308/EEC): This directive focused primarily on money laundering related to drug offenses and imposed obligations exclusively on the financial sector.

- Extension of Scope (Directive 2001/97/EC): The scope of the initial directive was broadened both in terms of the crimes covered and the range of professions and activities included. This expansion moved beyond drug-related offenses to encompass other types of criminal activities.

- Inclusion of Terrorist Financing (Post-2003 FATF Recommendations): Following the revision of the Financial Action Task Force (FATF) Recommendations in 2003, which for the first time covered terrorist financing, there was a significant shift in focus. The FATF also provided more detailed requirements regarding customer identification and verification, as well as guidelines for situations warranting enhanced measures due to a higher risk of money laundering or terrorist financing, and those that might justify less stringent controls due to reduced risk.

Incorporation of FATF Changes into EU Legislation

- The FATF’s expanded focus and detailed recommendations were incorporated into the EU’s legislative framework through Directive 2005/60/EC and Commission Directive 2006/70/EC. These directives reflected the broader approach to tackling not just money laundering but also the financing of terrorism.

Directive (EU) 2018/1673

Directive (EU) 2018/1673 focuses on defining and criminalizing money laundering and its predicate offenses, also known as criminal activities. Here’s a summary with a specific focus on „money laundering“ and „predicate offenses„:

Predicate Offenses (Criminal Activities)

- Defined broadly, encompassing any offense punishable by more than one year of imprisonment (or more than six months in Member States with minimum thresholds).

- Includes a wide range of offenses, such as organized crime, terrorism, human trafficking, sexual exploitation, drug trafficking, arms trafficking, corruption, fraud, currency counterfeiting, environmental crime, murder, kidnapping, robbery, smuggling, tax crimes, extortion, forgery, insider trading, market manipulation, and cybercrime.

Money Laundering Offences

- Criminalization of Money Laundering Activities:

- Conversion or Transfer of Property: Criminalizes converting or transferring property known to be derived from criminal activity, with the intent to conceal its illicit origin or assist others involved in the criminal activity.

- Concealment or Disguise: Criminalizes concealing or disguising the true nature, source, location, or ownership of property derived from criminal activity.

- Acquisition, Possession, or Use: Criminalizes acquiring, possessing, or using property known to be derived from criminal activity.

- Knowledge and Suspicion:

- Allows for criminalization based on suspicion or reasonable belief that the property was derived from criminal activity.

- Conviction Conditions:

- Conviction does not require prior conviction for the predicate offense.

- Allows conviction based on the establishment that the property was derived from criminal activity, without needing full details of the predicate offense.

- Extends offenses to property derived from activities in other Member States or third countries, with certain conditions.

- Cross-Border Conduct:

- Member States may require that the conduct in another state or third country be a criminal offense there, with exceptions for specific offenses.

- Self-Laundering:

- Criminalizes self-laundering, where individuals involved in the predicate offense engage in money laundering activities.

Aiding and Abetting, Inciting and Attempting

- Ancillary Offenses:

- Criminalizes aiding and abetting, inciting, and attempting money laundering offenses.

German German Criminal Code

Section 261 of the German Criminal Code (Strafgesetzbuch – StGB) addresses the offense of money laundering as follows:

Criminalization of Money Laundering Acts

- A person is subject to up to five years of imprisonment or a fine if they intentionally:

- Conceal an object derived from an illegal act,

- Exchange, transfer, or move such an object to prevent its discovery, seizure, or the determination of its origin,

- Procure the object for themselves or a third party,

- Store or use the object for themselves or a third party, knowing its illegal origin at the time of obtaining it.

- Exceptions apply to objects previously obtained by a third party without committing an illegal act and to defense lawyers who accept fees knowingly derived from illegal activities.

Concealment or Obscuration of Relevant Facts

- Criminalizes hiding or obscuring facts significant for discovering, seizing, or determining the origin of objects involved in money laundering.

Attempted Offenses

- Attempts to commit money laundering offenses are punishable.

Increased Penalties for Obligated Parties

- Obligated parties under the Money Laundering Act committing these acts face imprisonment ranging from three months to five years.

Penalties in Particularly Severe Cases

- In severe cases, such as commercial activity or gang involvement in continuous money laundering, imprisonment ranges from six months to ten years.

Negligent Failure to Recognize

- Negligently failing to recognize the nature of the object in question can lead to imprisonment for up to two years or a fine, with specific exceptions for defense lawyers.

Predicate Offense Participation

- A person involved in the predicate offense is punishable under this section only if they circulate the object and obscure its illegal origin.

Exemption from Punishment

- Exemptions apply to those who voluntarily report the offense to authorities, provided the act wasn’t already known to authorities, and the offender was unaware of its discovery.

Equivalent Objects from Abroad

- Objects originating from acts committed abroad are treated as equivalent if they would constitute an illegal act under German law and are punishable either at the place of the act or under specified EU provisions and conventions.

Seizure of Objects

- Objects related to the criminal offense can be seized, with applicable sections of the German Penal Code taking precedence over seizure provisions.

Sources:

- United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1988 https://www.unodc.org/pdf/convention_1988_en.pdf

- Council Directive 91/308/EEC https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A31991L0308

- Directive 2001/97/EC https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=celex%3A32001L0097

- Directive 2005/60/EC https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32005L0060

- Directive (EU) 2015/849 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32015L0849

- Directive (EU) 2018/1673 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32018L1673

- German German Criminal Code https://www.gesetze-im-internet.de/englisch_stgb/index.html