Educated Guess: Hottest candidates for direct AMLA supervision

The latest agreement grants AMLA the authority to directly supervise high-risk credit and financial institutions, including cross-border and crypto asset service providers.

AMLA will select and oversee up to 40 high-risk entities across member states through joint supervisory teams, conducting assessments and inspections.

Non-selected entities will continue to be supervised at the national level.

In the non-financial sector, AMLA will support national supervisors by reviewing and investigating compliance with the AML/CFT framework and can issue non-binding recommendations.

Additionally, the agreement enhances AMLA’s supervisory capabilities by requiring the maintenance of an up-to-date central database for AML/CFT supervision.

Drawing upon the comprehensive findings from the EU Reports of 2017, 2019, and 2022, and the detailed risk assessments by BMF and BaFin, we crafted a first „shortlist“ of entities that stand at the threshold of AMLA’s direct oversight.

Financial Sector

Credit Institutions

- BNP Paribas SA

- Crédit Agricole Group

- Banco Santander SA

- Groupe Banque Populaire Caisse d’Epargne (BPCE)

- Société Générale SA

- Deutsche Bank AG

- Intesa Sanpaolo SpA

- ING Groep NV

- UniCredit SpA

- Crédit Mutuel Group

Payment Institutions and Electronic Money Institutions

- Revolut

- Klarna

- N26

- TransferWise

- Stripe Payments Europe

- PayPal Europe

- Adyen

- Skrill

- Paysafe Financial Services

- Checkout Ltd

Investment Management and Asset Management

- Amundi Asset Management

- Legal & General Investment Management

- BNP Paribas Asset Management

- BlackRock

- Natixis Investment Management

- AXA Group

- EXOR SpA

- Brera Holdings PLC

- ADC Therapeutics SA

- Merus N.V.

Factoring and Financial Leasing

- ALD LeasePlan (Ayvens)

- Volkswagen Financial Services

- Arval

- Athlon (Mercedes-Benz Mobility)

- Mobilize Financial Services

- Alphabet (BMW Financial Services)

- Leasys

- ING Lease

- BNP Paribas Leasing Solutions

- Société Générale Equipment Finance

Crypto-asset Service Provider (CASP)

- eToro

- Bybit

- Uphold

- Bitpanda

- Kraken

- OKX

- Binance

- Coinbase

- Zeply

- Kucoin

Life Insurance

- AXA

- Allianz

- Assicurazioni Generali

- HDI

- Credit Agricole Assurances

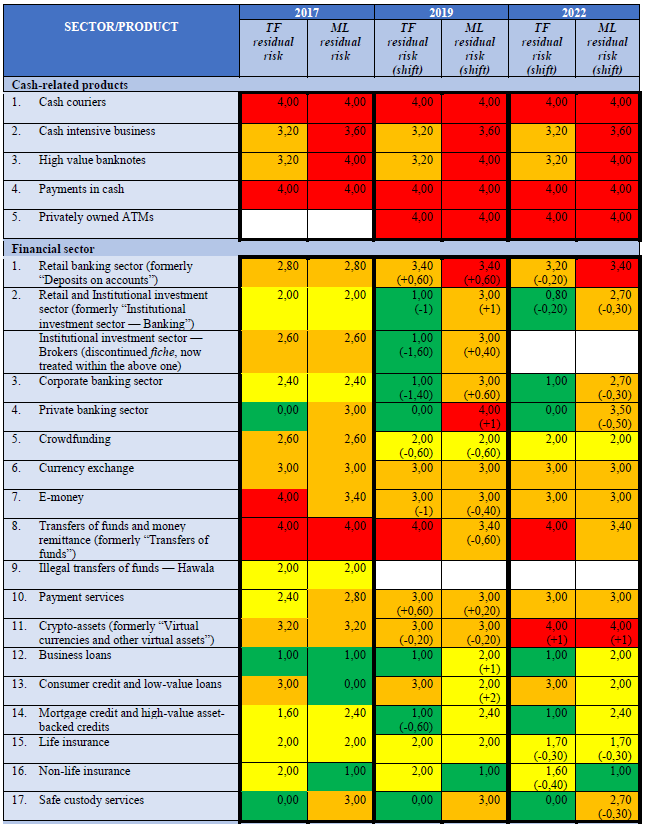

EU Report on the assessment of the risk of money laundering and terrorist financing affecting the internal market and relating to cross-border activities 2022

The EU „Report on the assessment of the risk of money laundering and terrorist financing affecting the internal market and relating to cross-border activities 2022“ shows a differentiated risk assessment of the ML/TF risks with regards to cash-related products, in the Financial Sector, in the Non-Financial Sector as well as Gambling, Non-Profit Organisations (NPOs), Professional Sports, Free-Trade Zones and Citizenship-Residence for 2017, 2019 and 2022.

High Money Laundering (ML) Residual Risk in the Financial Sector

- Retail banking sector (formerly “Deposits on accounts”)

- Crypto-assets (formerly “Virtual currencies and other virtual assets”)

Medium-High Money Laundering (ML) Residual Risk in the Financial Sector

- Retail and Institutional investment sector (formerly “Institutional investment sector — Banking”)

- Institutional investment sector — Brokers (discontinued fiche, now treated within the above one)

- Corporate banking sector

- Private banking sector

- Currency exchange

- E-money

- Transfers of funds and money remittance (formerly “Transfers of funds”)

- Payment services

- Safe custody services

High Terrorist Financing (TF) Residual Risk in the Financial Sector

- Transfers of funds and money remittance (formerly “Transfers of funds”)

- Crypto-assets (formerly “Virtual currencies and other virtual assets”)

Medium-High Terrorist Financing (TF) Residual Risk in the Financial Sector

- Retail banking sector (formerly “Deposits on accounts”)

- Currency exchange

- E-money

- Payment services

- Consumer credit and low-value loans

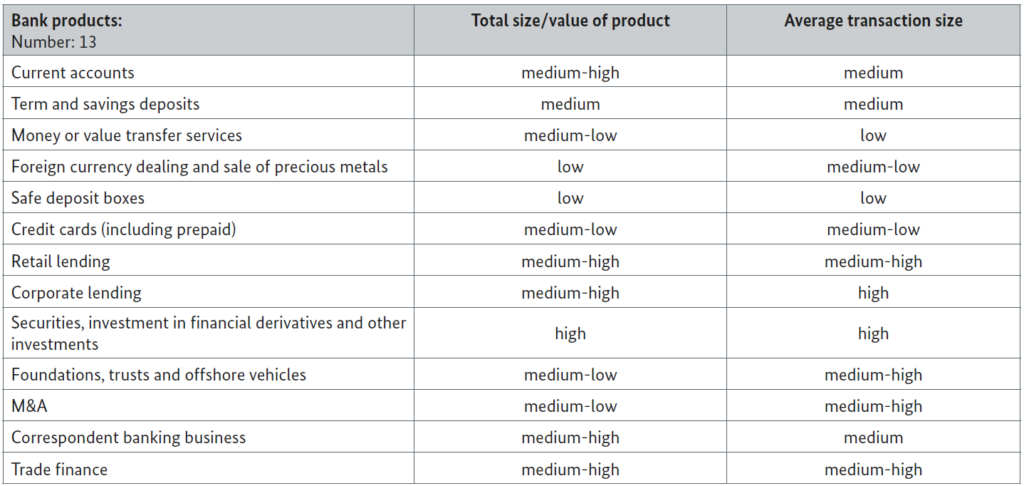

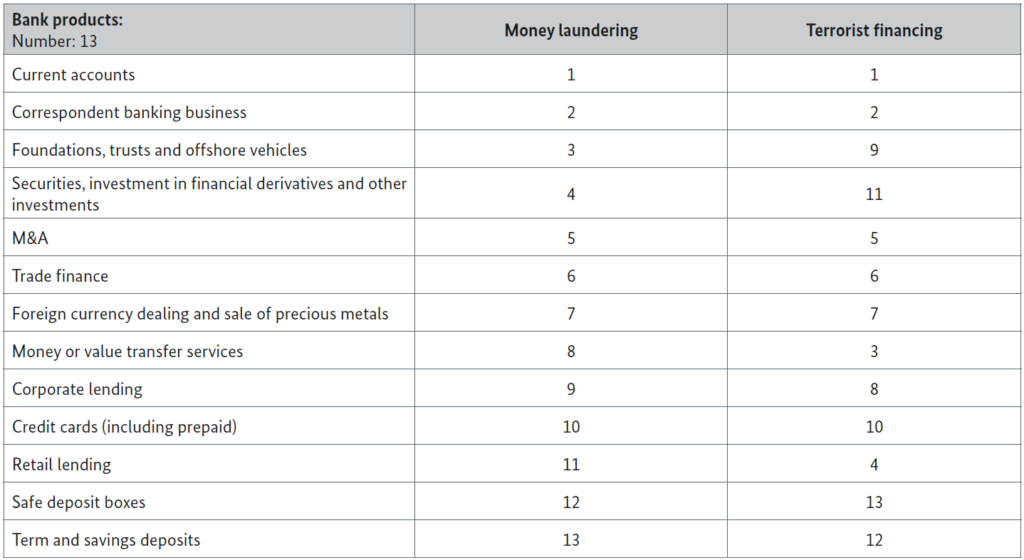

BMF First National Risk Assessment 2018/2019

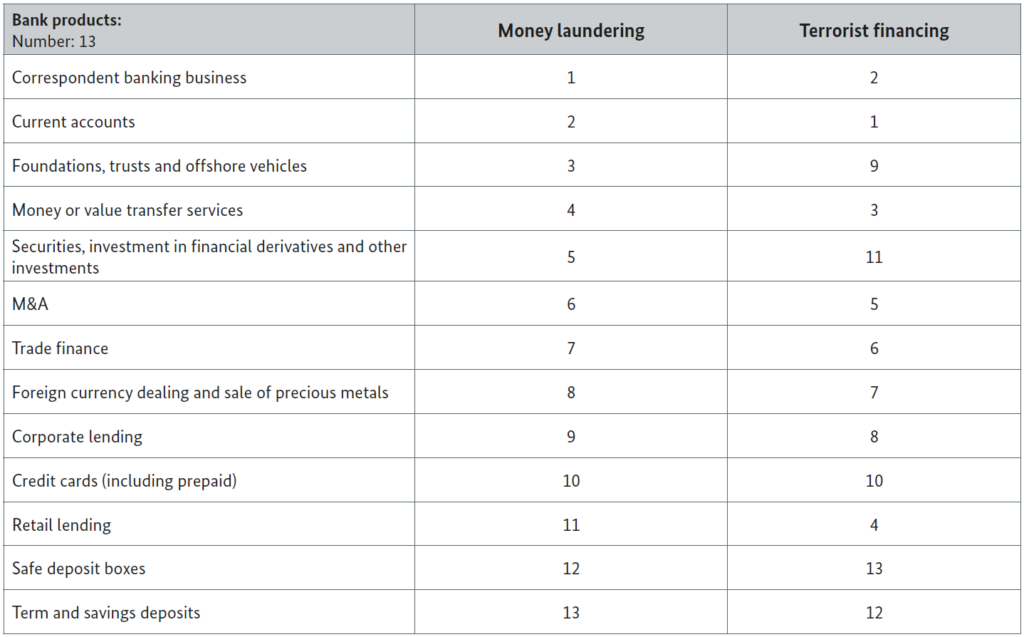

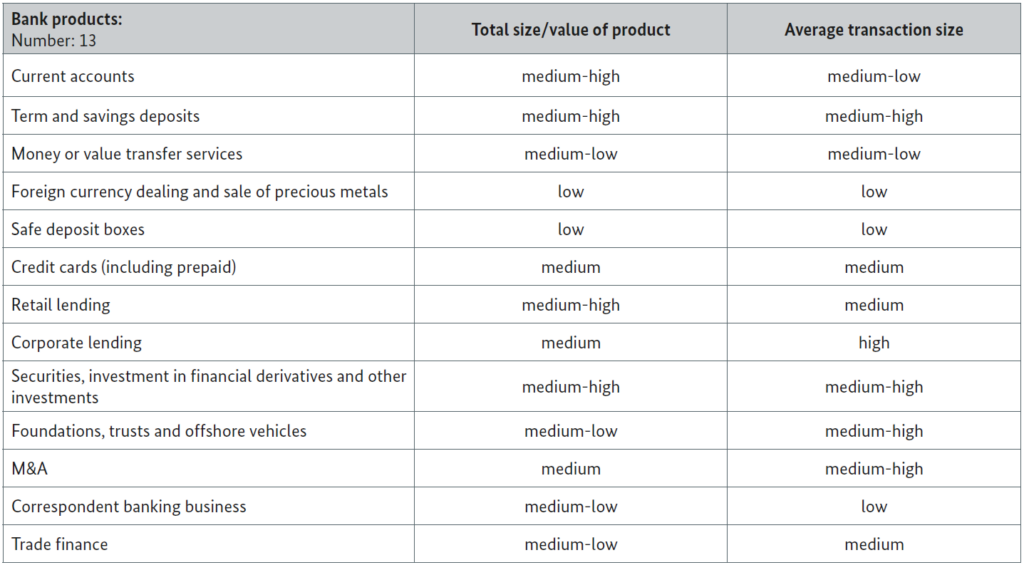

Major banks

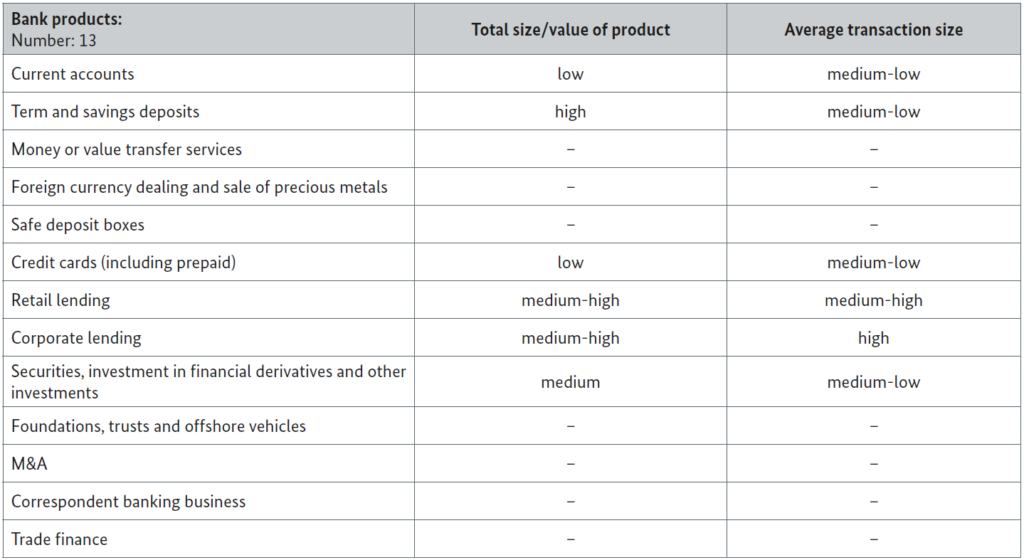

Total size/value of products and average transaction size among major banks

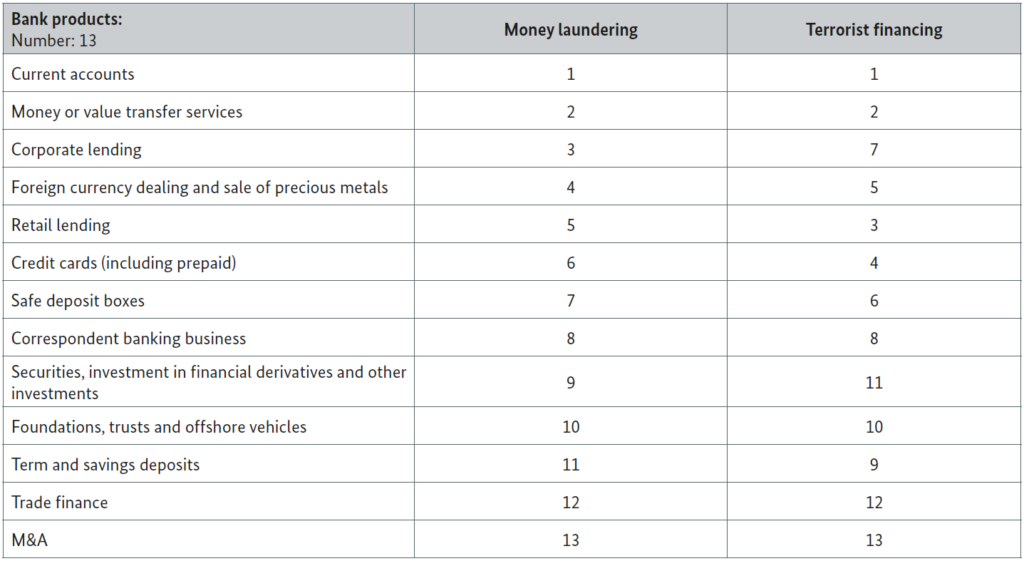

Ranking of the products of major banks by risk

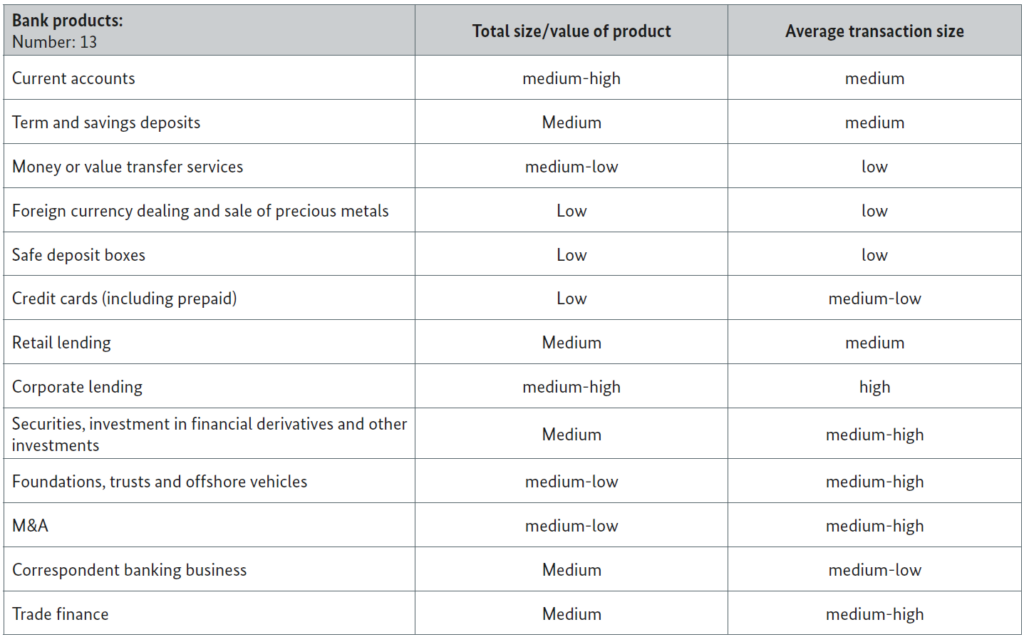

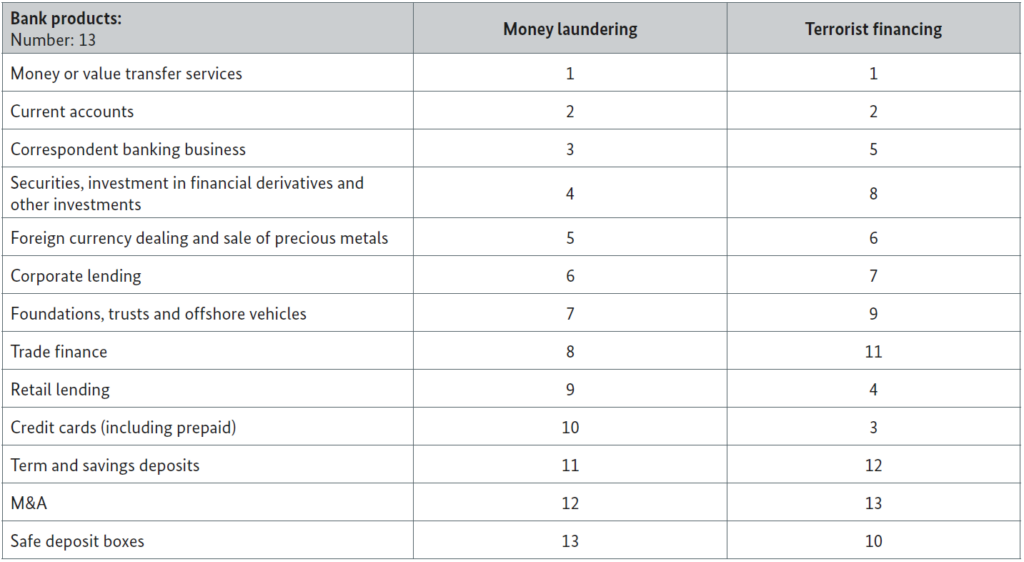

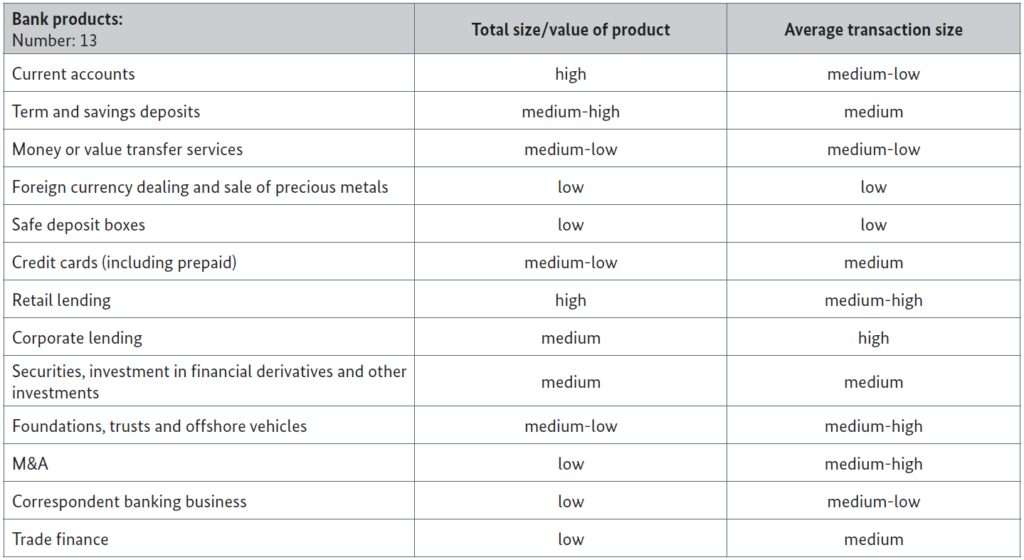

Branches and branch offices of foreign banks

Total size/value of products and average transaction size among branches and branch offices

Ranking of the products of branches and branch offices by risk

Regional banks and other commercial banks

Total size/value of products and average transaction size among regional banks and other commercial banks

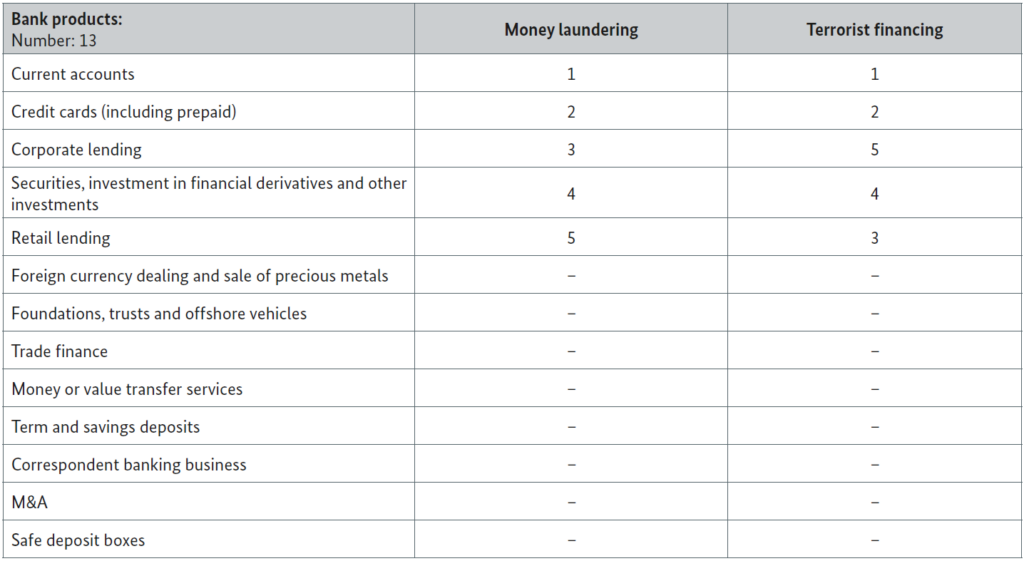

Ranking of the products of regional banks and other commercial banks by risk

Banks in the affiliated banks category

Total size/value of products and average transaction size among the affiliated banks category

Ranking of the products of affiliated banks by risk

Other credit institutions

Total size/value of products and average transaction size among banks in the other credit institutions category

Ranking of the products of other credit institutions by risk

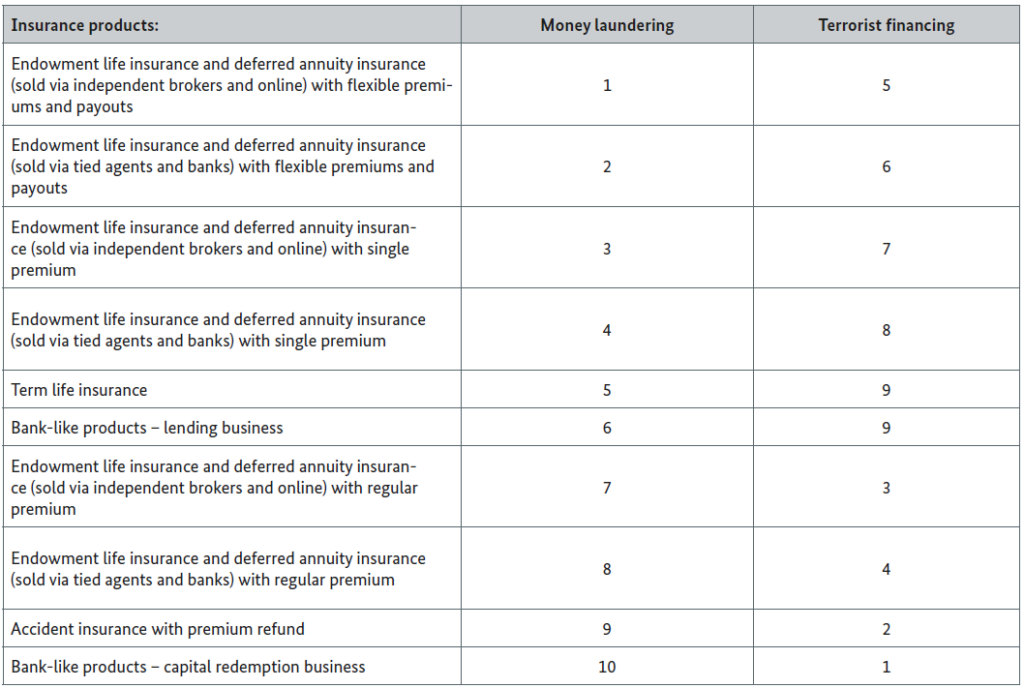

Insurance

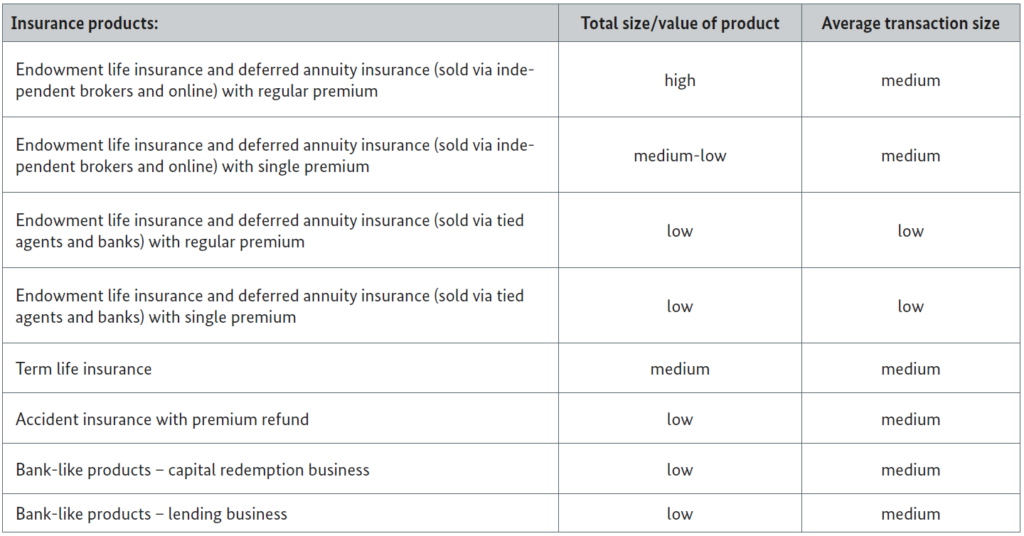

Total size/value of each product and use of intermediaries in insurance

Ranking of insurance products by risk

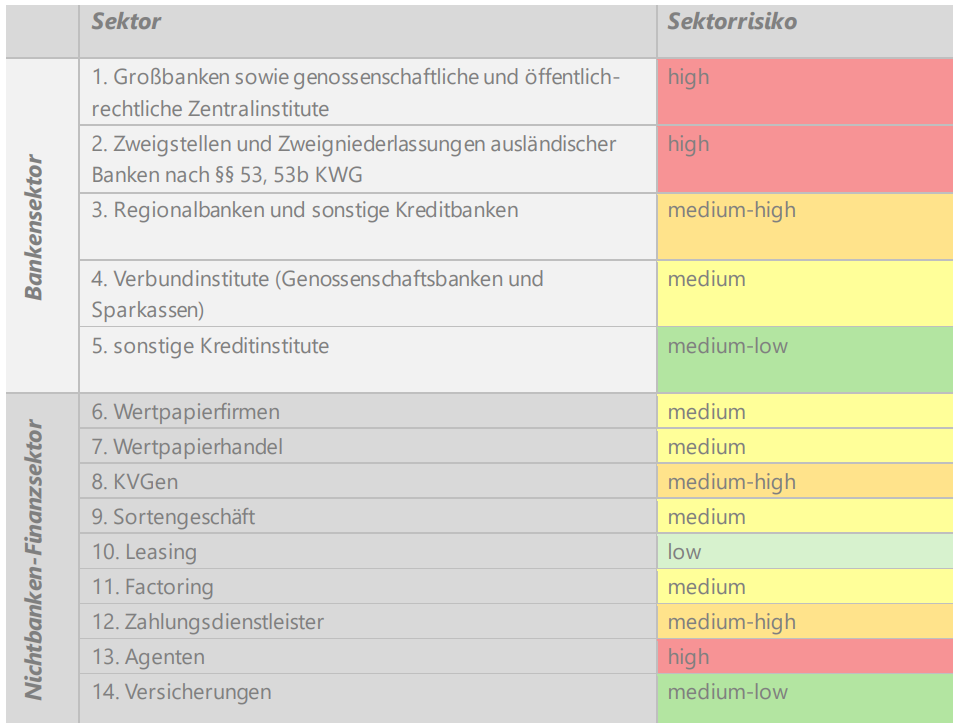

BaFin Subnational Risk Analysis 2019/2020 (SRA 2.0)

The BaFin Subnational Risk Analysis 2019/2020 (SRA 2.0) shows a differentiated risk analysis of the ML/TF risks in the banking sector and the non-bank financial sector divided into sectors and subsectors:

High Risk

- Major banks as well as cooperative and public law central institutions

- Branches and subsidiaries of foreign banks according to §§ 53, 53b KWG (German Banking Act)

- Agents [for payment service providers]

Medium-High Risk

- Regional banks and other credit banks

- Capital management companies

- Payment service providers

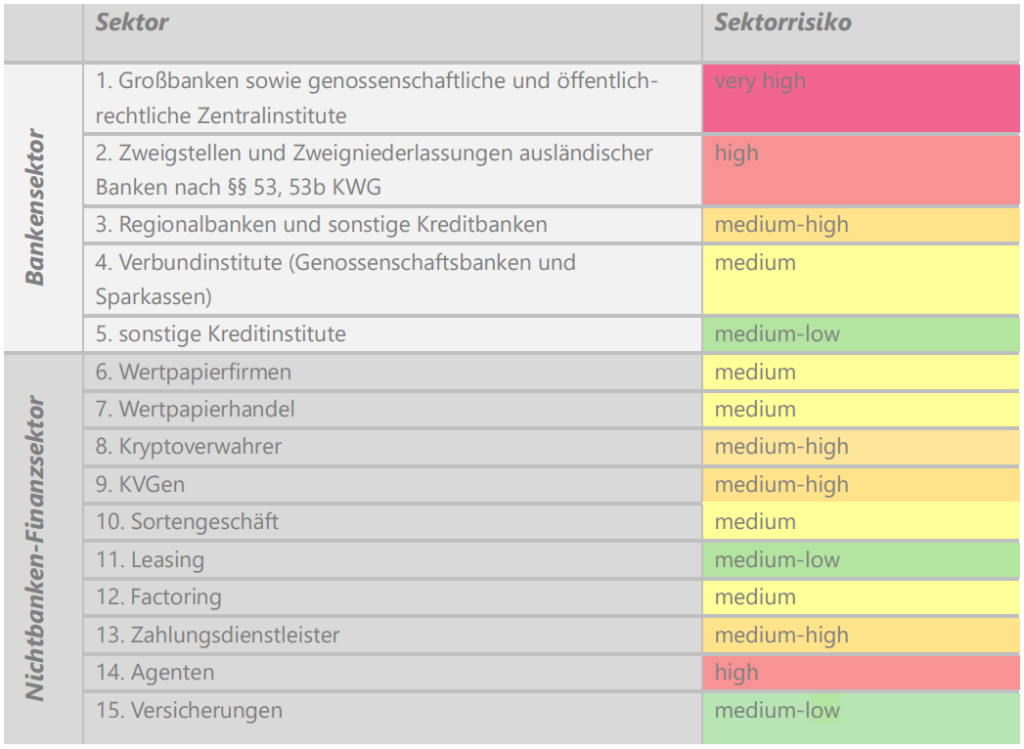

BaFin Subnational Risk Analysis 2021/2022 (SRA 3.0)

The BaFin Subnational Risk Analysis 2021/2022 (SRA 3.0) shows a differentiated risk analysis of the ML/TF risks in the banking sector and the non-bank financial sector divided into sectors and subsectors:

Very High Risk

- Major banks as well as cooperative and public law central institutions

High Risk

- Branches and subsidiaries of foreign banks according to §§ 53, 53b KWG (German Banking Act)

- Agents [for payment service providers]

Medium-High Risk

- Regional banks and other credit banks

- Crypto custodians

- Capital management companies

- Payment service providers

Sources:

- Anti-money laundering: Council and Parliament agree to create new authority https://www.consilium.europa.eu/en/press/press-releases/2023/12/13/anti-money-laundering-council-and-parliament-agree-to-create-new-authority/

- Final Draft AMLAR https://data.consilium.europa.eu/doc/document/ST-6222-2024-INIT/en/pdf

- EU Supranational Risk Assessment (SNRA)

- Report on the assessment of the risk of money laundering and terrorist financing affecting the internal market and relating to cross-border activities https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52022DC0554

- COMMISSION STAFF WORKING DOCUMENT Accompanying the document REPORT FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT AND THE COUNCIL on the assessment of the risk of money laundering and terrorist financing affecting the internal market and relating to cross-border activities https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52022SC0344

- BMF „First National Risk Assessment 2018/2019“ https://www.bundesfinanzministerium.de/Content/EN/Standardartikel/Press_Room/Publications/Brochures/2020-02-13-first-national-risk-assessment_2018-2019.html

- BaFin „Subnationale Risikoanalyse 2019/2020 (SRA 2.0)“ https://www.bafin.de/SharedDocs/Downloads/DE/Bericht/dl_sra_20_gw.html

- BaFin „Subnationale Risikoanalyse 2021/2022 (SRA 3.0)“ https://www.bafin.de/SharedDocs/Downloads/DE/Bericht/dl_sra_21_gw.html