Why does the extent of measures often not correspond to the risk?

The extent of due diligence and monitoring measures does not always align with the actual risk level.

This discrepancy is particularly evident in cases of „professional money laundering,“ where multiple high-risk factors converge, complicating the detection and mitigation efforts of obliged entities.

Professional money laundering schemes are sophisticated operations designed to obscure the illegal origins of money. These operations frequently involve several high-risk indicators simultaneously, making them particularly elusive targets for AML measures.

Obliged entities must tailor their due diligence efforts based on the risk level; however, the multifaceted nature of professional money laundering presents unique challenges.

Unusual Business Relationships

One of the red flags for higher AML risk is when a business relationship is conducted under unusual circumstances. Professional money launderers often employ complex transactions that appear legitimate but are designed to confuse and obfuscate, making it difficult for financial institutions to apply the appropriate level of scrutiny.

High-Risk Geographical Locations

The involvement of customers resident in high-risk geographical areas, particularly those considered „tax havens,“ adds another layer of complexity. These jurisdictions often have lax regulatory frameworks, making them attractive for concealing the proceeds of crime.

Complex Legal Entities

Professional money launderers frequently use personal asset-holding vehicles and legal entities with intentionally convoluted ownership structures to disguise the true beneficiaries of illicit funds. Obliged entities must undertake rigorous checks to understand the ownership and control structure of their clients. However, the deliberate complexity and transnational nature of these entities often outpace the investigative capabilities of financial institutions, leading to a mismatch between the perceived and actual risk.

Non-Face-to-Face Business Relationships

The rise of digital finance has increased the prevalence of non-face-to-face business relationships, which, while convenient, offer a veil of anonymity to illicit actors. The sophisticated use of technology by professional money launderers can make it challenging to effectively verify identities and understand the nature of the business relationship.

Third-Party Payments

Another common characteristic of professional money laundering is the use of third-party payments, which can obscure the trail of money and disconnect it from its illegal origins. Obliged entities must scrutinize such transactions carefully, the global and interconnected nature of financial systems can make tracing the original source a daunting task.

The advanced tactics employed in professional money laundering often result in a disparity between the level of measures taken by obliged entities and the actual risk presented.

Correlation and Covariance of high risk factors

There are coincidences that are no longer coincidence when it comes to identifying patterns of high-risk factors in money laundering schemes.

The correlation and covariance of these high-risk factors, such as unusual business relationships, dealings in high-risk geographical areas, complex legal entity structures, non-face-to-face interactions, and third-party payments, often signal a deliberate strategy employed by professional money launderers.

When these factors appear in tandem, it’s not merely a happenstance but a calculated attempt to exploit systemic vulnerabilities. The interplay between these elements can magnify the overall risk, making it imperative for obliged entities to not only assess these factors in isolation but to understand their interconnected nature.

Recognizing the covariance among these high-risk indicators can enhance the predictive power of risk assessment models, allowing financial institutions to implement more targeted and effective AML measures.

This deeper analytical approach, which goes beyond surface-level assessments, is crucial for dismantling sophisticated laundering operations that seek to blend illicit funds seamlessly into the global financial system.

Ignorance is bliss or not?

„Ignorance Is Bliss or Not“ highlights a paradox within the AML frameworks of obliged entities.

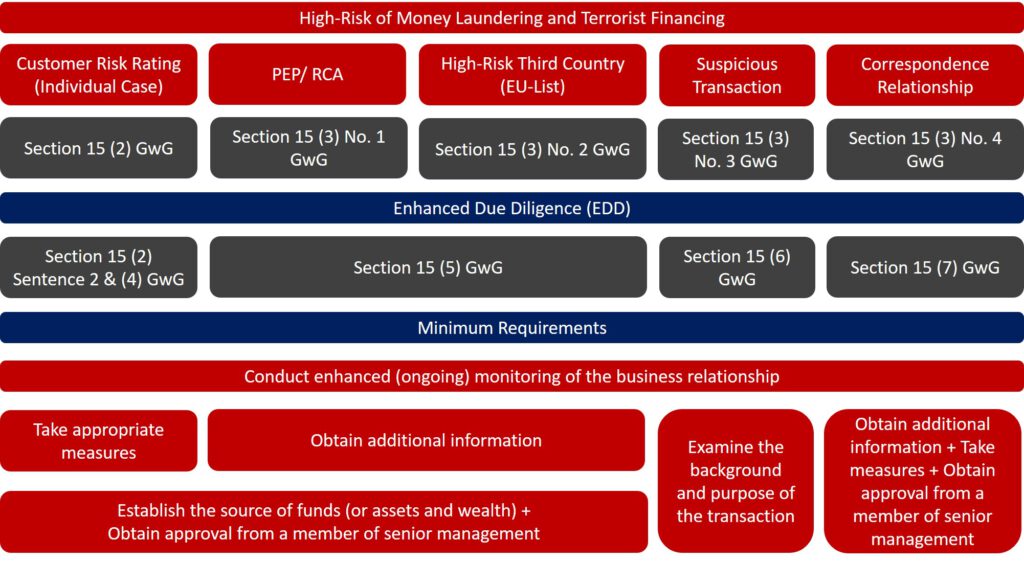

While most financial institutions and obliged entities are adept at managing well-defined risk categories such as Politically Exposed Persons (PEPs), Relationships with Correspondent Accounts (RCAs), transactions linked to High-Risk Third Countries, and overtly Suspicious Transactions, they often falter with „Individual Cases.“

These cases, which do not neatly fit into predefined risk categories, require a nuanced and tailored approach to risk assessment. The complexity and uniqueness of each individual case can lead to oversight or underestimation of risk, as these situations demand a level of scrutiny and adaptability that goes beyond standard procedures.

This gap in the application of AML measures underscores the necessity for a more dynamic and discerning approach to risk management, where the knowledge and expertise used to handle common risk categories must be equally applied to the intricate and less straightforward individual cases.

Sources:

- FATF-Report „Professional Money Laundering“ https://www.fatf-gafi.org/en/publications/Methodsandtrends/Professional-money-laundering.html

- Directive (EU) 2015/849 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32015L0849

- Directive (EU) 2018/843 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32018L0843

- German Anti-Money Laundering Act (Geldwäschegesetz – GwG) https://www.bafin.de/SharedDocs/Downloads/EN/Aufsichtsrecht/dl_gwg_en.html

- BaFin-Interpretation and Application Guidance on the German Money Laundering Act (October 2021) https://www.bafin.de/SharedDocs/Downloads/EN/Auslegungsentscheidung/dl_ae_auas_gw2021_en.html

- BaFin-Conference on the prevention of money laundering and terrorist financing https://www.bafin.de/SharedDocs/Veranstaltungen/DE/2023_12_07_Geldwaeschebekaempfung.html