What Is the Travel Rule?

The Travel Rule is a cornerstone of modern anti-money laundering and counter-terrorist financing (AML/CFT) frameworks. First introduced by the Financial Action Task Force (FATF) in Recommendation 16, it ensures that identifying information about the originator and beneficiary “travels” with a payment or transfer.

Originally applied to wire transfers in the banking sector, the Travel Rule was expanded in 2019 to cover virtual assets and virtual asset service providers (VASPs). This closed a regulatory gap by bringing cryptocurrency transactions under the same AML/CFT standards as traditional finance.

FATF and the Global Standard

According to FATF Recommendation 16, financial institutions and VASPs must:

- Collect and verify accurate originator data (name, account/wallet, address or ID details).

- Collect beneficiary information (name, account/wallet).

- Ensure this data is transmitted securely and immediately to the receiving institution.

- Detect, report, and act on missing or incomplete information.

FATF’s guidance treats all virtual asset transfers as cross-border, reflecting the global, borderless nature of blockchain technology.

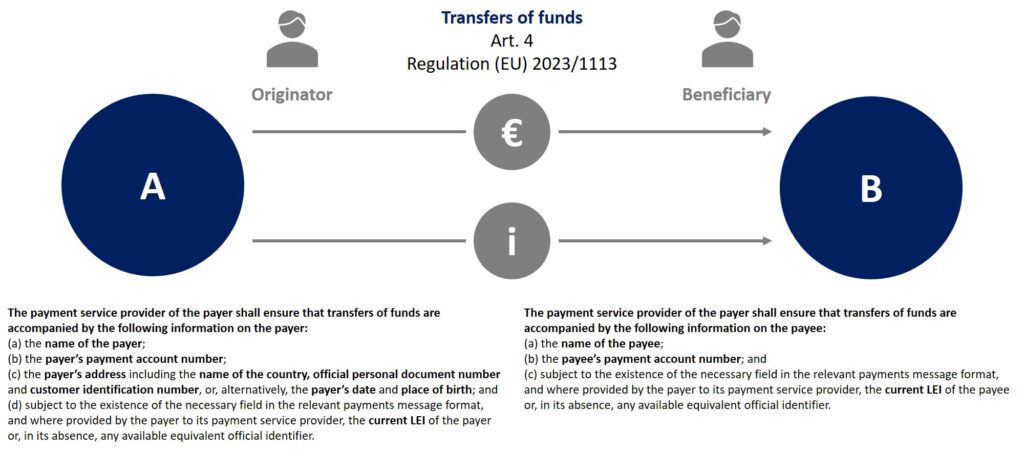

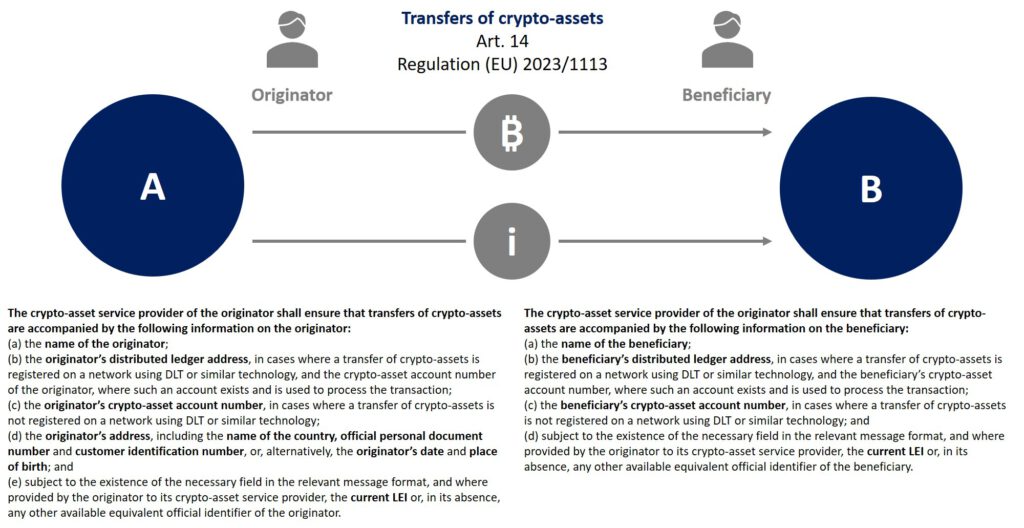

The EU’s Transposition: Regulation (EU) 2023/1113

The European Union formally embedded the Travel Rule through Regulation (EU) 2023/1113, also known as the new Funds Transfer Regulation (FTR). Key features include:

- Universal scope: Applies to all crypto-asset transfers, regardless of amount.

- Mandatory data fields: Names, wallet or account numbers, addresses, IDs or date/place of birth.

- Self-hosted wallets: Transfers ≥ EUR 1,000 must include additional checks to verify ownership or control.

- Intermediary providers: Must preserve and pass along Travel Rule data through the entire chain.

- Risk-based enforcement: Missing information can lead to suspension, rejection, or suspicious transaction reporting.

This ensures that crypto-asset service providers (CASPs) are regulated in the same way as payment service providers (PSPs).

The EBA Travel Rule Guidelines

To harmonize implementation across the EU, the European Banking Authority (EBA) published Travel Rule Guidelines (EBA/GL/2024/11). These guidelines:

- Replace the 2017 ESA guidelines for funds transfers.

- Apply to both funds and crypto-asset transfers from 30 December 2024.

- Provide detailed instructions on:

- Detecting missing or meaningless data (e.g., “xxxxx”).

- Handling repeated failures by counterparties.

- Managing transfers involving self-hosted wallets.

- Setting deadlines for responding to information requests.

- Allow a technical transition period for CASPs until 31 July 2025, provided compensating controls are in place.

Why the Travel Rule Matters

The Travel Rule is critical for:

- Traceability of fund and crypto-asset flows.

- Early detection of suspicious or high-risk transfers.

- Preventing anonymity misuse in crypto transactions.

- Ensuring regulatory alignment across jurisdictions.

For businesses, this means updating compliance frameworks, IT systems, and customer onboarding procedures to handle secure, immediate information sharing.

The Travel Rule has evolved from a banking compliance measure into a global standard for crypto-assets. With FATF Recommendation 16, Regulation (EU) 2023/1113, and the EBA Travel Rule Guidelines, the rule is now a binding requirement across Europe.

Downloads

Sources:

https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A32023R1113