Contents

Suspicious Transaction Reports (STRs) in numbers

The world of financial compliance and anti-money laundering (AML) efforts has been bolstered significantly in recent years by directives and regulations aimed at curbing illicit activities.

Suspicious Transaction Reports (STRs) are at the forefront of this fight, serving as a critical tool for financial institutions and obliged entities to flag potentially illicit activities. The evolution of STRs, especially within the European Union, reflects the continuous and dynamic effort to strengthen AML frameworks.

A comprehensive look at AML/ CTF efforts in Europe

The Rise in STRs: A Numerical Perspective

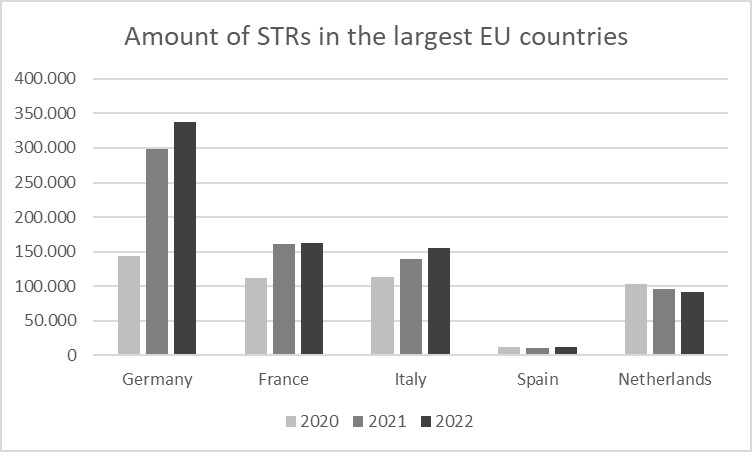

Recent numbers from EU Financial Intelligence Units (FIUs) indicate a discernible rise in STR submissions. Germany’s FIU, for instance, has shown a remarkable uptick in STRs, with figures soaring from 144,005 in 2020 to 337,186 in 2022. This significant increase is mirrored in the data from France’s TRACFIN and Italy’s UIF, with their numbers also demonstrating marked growth over the same period.

| Country | FIU | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Germany | FIU | 144,005 | 298,507 | 337,186 |

| France | TRACFIN | 111,661 | 160,952 | 162,708 |

| Italy | UIF | 113,187 | 139,524 | 155,426 |

| Spain | SEPBLAC | 12,683 | 11,459 | 12,796 |

| Netherlands | FIU-NL | 103,947 | 96,676 | 91,893 |

| Poland | GIFI | 3,805 | 3,852 | 4,505 |

| Belgium | CTIF-CFI | 31,605 | 46,330 | 0 |

| Sweden | NFIS | 24,505 | 37,528 | 45,113 |

| Ireland | MLIU | 29,621 | 35,239 | 0 |

| Austria | A-FIU | 4,356 | 4,994 | 6,053 |

Impact of AMLD on STR Reporting

The numbers we observe today can be traced back to the strategic implementations of the 4th AMLD (Directive (EU) 2015/849) and its successor, the 5th AMLD (Directive (EU) 2018/843). The 4th AMLD established stringent cooperation requirements for reporting suspicious transactions, irrespective of the transaction amount. Its update through the 5th AMLD simplified the direct reporting process to FIUs, ensuring more efficient STR submissions. These legislative frameworks have significantly contributed to the heightened reporting activity, as evidenced by the increased numbers.

Germany’s GwG and BaFin’s Interpretive Guidance

Germany’s Geldwäschegesetz (GwG) has been instrumental in shaping the national landscape of STR reporting. Section 43 of the GwG specifically details the obligation to report transactions linked to money laundering or terrorist financing. BaFin’s interpretive guidance further clarifies these obligations, emphasizing the urgency of reporting and the comprehensive assessment required by obliged entities. This guidance has undoubtedly played a role in the substantial growth of STRs in Germany, as compliance entities strive to meet regulatory expectations.

A Closer Look at 2022 Numbers

The year 2022, while still registering an overall high number of STRs, showed a slight decrease compared to 2021. The reasons behind this dip are not immediately clear from the numbers alone and could stem from a variety of factors, including improved preventive measures, fluctuations in criminal activities, or changes in reporting mechanisms.

The Road Ahead

The data from FIUs across Europe underscores the collective effort to enhance AML measures. With every submitted STR, the financial sector becomes a more challenging environment for money launderers and financiers of terrorism. As the AMLD continues to evolve and national laws like Germany’s GwG get fine-tuned, we can expect STR numbers to reflect the effectiveness and responsiveness of the financial sector’s commitment to combating financial crimes.

Final Thoughts

Suspicious Transaction Reports are more than just numbers; they represent the vigilance and dedication of countless individuals and institutions safeguarding the integrity of the financial system. With the EU’s continued legislative support and the proactive measures of member states, STRs will remain a cornerstone in the architecture of AML efforts.

4 AMLD

The 4th AMLD (Directive (EU) 2015/849), specifically Article 33, primarily addresses the requirements for reporting suspicious transactions to the Financial Intelligence Units (FIUs) by “obliged entities,” which include financial institutions and other entities susceptible to being used for money laundering or terrorist financing.

Mandatory Reporting and Cooperation

- Obliged entities, as well as their directors and employees, are required to fully cooperate with the FIUs. This involves promptly informing the FIU, on their own initiative, in two main scenarios: a) If they know, suspect, or have reasonable grounds to suspect that funds are the proceeds of criminal activity or are related to terrorist financing, regardless of the amount involved. b) They must promptly respond to requests by the FIU for additional information in such cases.

Reporting Procedure

- All suspicious transactions, including attempted transactions, must be reported to the FIU.

- The information must be transmitted to the FIU of the Member State in which the obliged entity transmitting the information is established. This is typically done by the person appointed under point (a) of Article 8(4) of the 4th AMLD.

Direct and Indirect Information Provision

- Obliged entities are also required to provide all necessary information, directly or indirectly, to the FIU upon its request. This is to be done in accordance with the procedures established by the applicable law.

5 AMLD

The 5th AMLD (Directive (EU) 2018/843), specifically the amendment to Article 33(1) in Directive (EU) 2015/849, reflects a key change regarding the reporting of Suspicious Transaction Reports (STRs) to Financial Intelligence Units (FIUs).

Modification of Information Provision Requirement

- The amendment in the 5th AMLD modifies Article 33(1), point (b) of the 4th AMLD.

- The original text of the 4th AMLD stated that obliged entities must provide the FIU, directly or indirectly, at its request, with all necessary information.

- The 5th AMLD amendment changes this to require that obliged entities provide the FIU directly, at its request, with all necessary information.

Implications of the Amendment

- This change emphasizes the direct interaction between obliged entities and FIUs.

- The removal of the phrase “directly or indirectly” indicates a more straightforward and possibly more efficient process for the provision of information to FIUs.

- It suggests a preference for a direct line of communication and information transfer between obliged entities and FIUs, potentially reducing the complexity or ambiguity in the reporting process.

Focus on STRs

- While the amendment does not explicitly mention Suspicious Transaction Reports, it is inherently connected to the process of reporting suspicious activities.

- Ensuring direct provision of information to FIUs may facilitate quicker response and investigation of STRs, thereby enhancing the effectiveness of measures against money laundering and terrorist financing.

German GwG

The German Geldwäschegesetz (GwG), or Money Laundering Act, in Section 43, outlines specific obligations regarding the reporting of suspicious transactions. This section is primarily focused on the reporting obligation of obliged entities in the context of Suspicious Transaction Reports (STRs). Here’s a summary of the key aspects:

Conditions Triggering the Reporting Obligation

- The reporting obligation arises when there are facts indicating one of the following scenarios:

- An asset involved in a business relationship, brokerage, or transaction originates from a criminal offense that could constitute a predicate offense for money laundering.

- A business transaction, other transaction, or asset is related to terrorist financing.

- The contracting party fails to fulfill its obligation under section 11(6), sentence 3, to disclose whether it intends to conduct the business relationship or transaction on behalf of a beneficial owner.

Mandatory Reporting Regardless of Value or Amount

- Obliged entities must report the matter to the German Financial Intelligence Unit (FIU) without delay.

- This reporting obligation applies irrespective of the value of the property or the amount involved in the transaction.

Scope of Obliged Entities

- Section 43 does not specify the types of entities obliged to report, but based on the context of the GwG, this would typically include financial institutions, certain professionals, and businesses that are susceptible to being used for money laundering or terrorist financing.

Emphasis on Prompt Reporting

- The use of the term “without delay” underscores the urgency and immediacy required in reporting suspicious activities to the German FIU. This is critical for effective anti-money laundering (AML) and counter-terrorist financing (CTF) efforts.

Comprehensive Reporting Obligations

- The law covers a broad range of potential AML/CTF risks, including both direct involvement in transactions and indirect involvement, such as failing to disclose beneficial ownership information.

BaFin-Interpretation and Application Guidance on the German GwG

The BaFin Interpretation and Application Guidance on the German GwG (Geldwäschegesetz or Money Laundering Act) provides detailed instructions and clarifications regarding the Suspicious Transaction Report (STR) procedure as outlined in Section 43 of the GwG. Here’s a structured summary focusing on the main points:

Principle

- Primary Obligation: Reporting transactions indicating money laundering, terrorist financing, or failure of the contracting party to disclose a beneficial owner is a core obligation under the GwG.

- Penalties for Non-Compliance: Violations incur fines and, in some cases, criminal penalties.

Preconditions for Reporting

- Scope of Transactions: The obligation applies to all transactions, including non-cash, cash, and other asset transfers.

- No Minimum Threshold: Reporting is required regardless of transaction size or asset value.

- Post-Transaction Discovery: Reporting applies even if suspicious facts are discovered after a transaction is completed.

- Judgment and Assessment: Obliged entities must use their judgment and expertise to identify unusual or abnormal transactions within their professional context.

- Margin of Judgment: Obliged entities have limited discretion in determining what constitutes suspicious facts.

Reporting Obligation

- Independent Reporting Obligation: This applies when the contracting party fails to disclose whether they act for a beneficial owner.

Organisational Structure for Reporting

- Internal Procedures: Obliged entities must have internal mechanisms to register, forward, and report suspicious matters to the FIU.

Report Requirements

- Mandatory Form: Reports must be submitted electronically using the “goAML” system.

- Exceptional Cases: Alternative methods (fax, post) are allowed if electronic submission is disrupted.

Consequences of a Report

- Transaction Postponement: Transactions reported as suspicious can only proceed after clearance from the FIU or after a specified time has elapsed without objection.

- Urgent Case Rule: In cases where postponement is not possible, the transaction can proceed, but the report must be made immediately.

Forwarding of Information Concerning Reports

- Ban on Tipping Off: Entities must not inform parties involved about the report or related investigations.

- Exceptions: Sharing information is allowed under specific conditions, like within the same corporate group or with government bodies.

Termination of Business Relationships

- Enhanced Due Diligence: After a report, enhanced monitoring of the reported party is required.

- Relationship Termination: The decision to terminate a business relationship post-report is at the discretion of the obliged entity, but it should consider notifying the FIU and relevant authorities.

Sources:

- Directive (EU) 2015/849 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32015L0849

- Directive (EU) 2018/843 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32018L0843

- German Anti-Money Laundering Act (Geldwäschegesetz – GwG) https://www.bafin.de/SharedDocs/Downloads/EN/Aufsichtsrecht/dl_gwg_en.html

- BaFin-Interpretation and Application Guidance on the German Money Laundering Act (October 2021) https://www.bafin.de/SharedDocs/Downloads/EN/Auslegungsentscheidung/dl_ae_auas_gw2021_en.html

- Financial Intelligence Unit Germany (FIU) https://www.zoll.de/DE/FIU/Fachliche-Informationen/Jahresberichte/jahresberichte_node.html

- Intelligence Processing and Action against Illicit Financial Networks Unit (TRACFIN) https://www.economie.gouv.fr/tracfin/rapports-dactivite-et-danalyse

- Financial Intelligence Unit of Italy (UIF) https://uif.bancaditalia.it/pubblicazioni/rapporto-annuale/index.html

- Executive Service of the Commission for the Prevention of Money Laundering and Monetary Offences (SEPBLAC) https://www.sepblac.es/en/abt-sepblac/activity-data/

- Financial Intelligence Unit Netherlands (FIU-NL) https://www.fiu-nederland.nl/en/home/annual-reviews-fiu-the-netherlands/

- General Inspector of Financial Information (GIFI) https://www.gov.pl/attachment/a7c71769-74ac-4f5e-896a-424abfe8d3a1

- Belgian Financial Intelligence Processing Unit (CTIF-CFI) https://www.ctif-cfi.be/index.php/en/annual-reports

- Austrian FIU https://www.bundeskriminalamt.at/308/start.aspx

- Sweden National Financial Intelligence Service (NFIS) https://polisen.se/siteassets/dokument/polisens-arsredovisning/fipos-arsrapport/financial-intelligence-unit-annual-report-2022.pdf

- Ireland Bureau of Fraud Investigation (MLIU) https://www.amlcompliance.ie/annual-reports/

- BaFin regarding the “Suspicious Transaction Reporting System” https://www.bafin.de/EN/Aufsicht/Geldwaeschepraevention/Verdachtsmeldewesen/Verdachtsmeldewesen_node_en.html