Contents

Debunk the Junk

Welcome to „Debunk the Junk,“ the podcast that slices through the layers of financial deception to unveil the core of illicit activities.

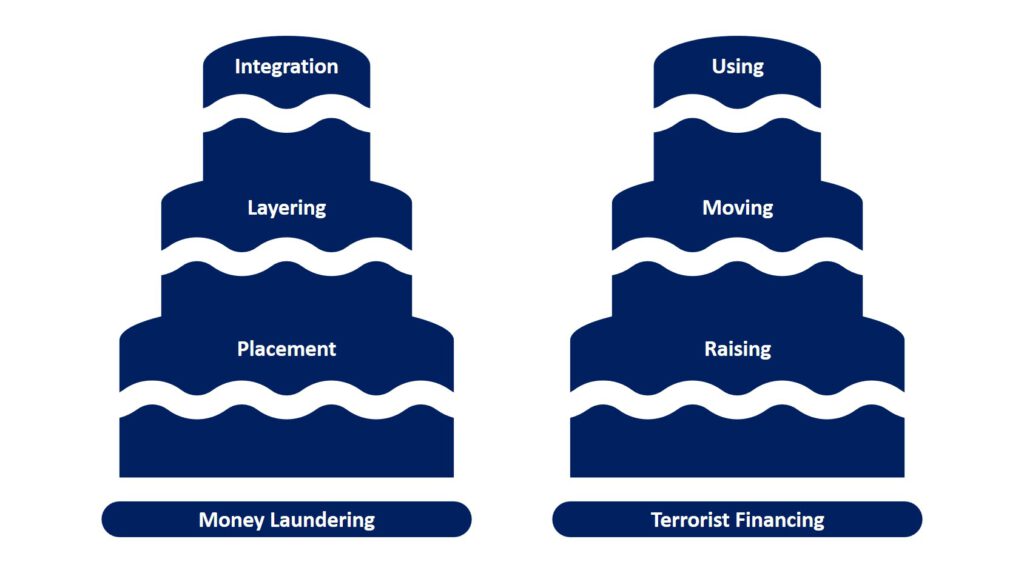

Two Cakes

Money Laundering

- Placement – Represented by the largest bottom layer, indicating the stage where the largest volume of illicit funds enters the financial system.

- Layering – Depicted as a smaller middle layer, suggesting that, during this stage, some of the money might be lost due to various transactions and fees.

- Integration – Shown as the smallest top layer, symbolizing that the amount of money finally integrated into the legitimate economy might be less due to the laundering process.

Terrorist Financing

- Raising – The large bottom layer represents the initial accumulation of funds, which is typically the largest bulk of resources gathered for terrorist activities.

- Moving – The middle layer is smaller, illustrating that moving funds can incur losses due to the costs and risks of transferring money clandestinely.

- Using – The top and smallest layer indicates that the amount of money actually used for terrorist acts may be less than what was initially raised, reflecting potential losses or expenditures along the way.

One Knife

Slice Through the Layers of Financial Deception. Uncover the truth with ‚Debunk the Junk,‘ as we dissect the complex world of money laundering and terrorist financing. From the initial Placement to final Integration, and from Raising to Using funds, we cut deep, revealing what remains after the financial facade falls away. Join us, where every slice exposes reality.

Leitner & Associates

Before we begin today’s episode of ‚Debunk the Junk,‘ we’d like to take a moment to thank our sponsor who make this podcast possible.

Specializing in Governance, Risk, and Compliance (GRC), Leitner & Associates is a boutique consultancy dedicated to helping organizations navigate complex regulatory landscapes. Their expertise in GRC ensures that businesses can operate with integrity and efficiency. Discover more about their holistic solutions and comprehensive products at leitnerassociates.com.

Episode 3: The 10 biggest money laundering fines so far

Welcome to „Debunk the Junk,“ where we bring clarity to the opaque world of financial crime. This is Episode 3, and today we’re diving into the „Hall of Shame“ of financial institutions — the 10 biggest money laundering fines in history. Strap in as we unravel the costly consequences of non-compliance.

BNP Paribas

At the top of our list, BNP Paribas, reeling from an $8.9 billion uppercut by the Justice Department for processing transactions in defiance of U.S. sanctions. Countries like Sudan, Iran, and Cuba were on the receiving end of these illicit finances.

BNP Paribas ($8.9 billion): Justice Department – Fined for processing transactions that violated U.S. sanctions against countries like Sudan, Iran, and Cuba.

UBS

Not far behind, UBS got slapped with a staggering ~$4.2 billion penalty. The New York Times reported their shady dealings, assisting the wealthy French to sneak past tax collectors, a classic tale of illegal solicitation and laundering.

UBS (~$4.2 billion): New York Times – Penalized for helping wealthy French clients evade taxes, involving illegal solicitation and money laundering.

Binance

Then there’s Binance, a relative newcomer, but no less notable, hit with a hefty $4 billion fine by the Justice Department. Their charge sheet? Money laundering and unlicensed money transmitting, a smorgasbord of sanctions violations.

Binance ($4 billion): Justice Department – Guilty of money laundering, unlicensed money transmitting, and sanctions violations, with poor controls enabling various illicit activities.

HSBC

HSBC’s tale is one of infamy, fined $1.256 billion for playing banker to Mexican drug cartels. Their anti-money laundering controls? More holes than Swiss cheese.

HSBC ($1.256 billion): Justice Department – Admitted to anti-money laundering and sanctions violations, particularly in facilitating transactions for Mexican drug cartels.

Danske Bank

Crossing over to Scandinavia, Danske Bank waves its not-so-golden ticket of 15.3 billion Danish kroner. Their Estonian branch? A veritable laundromat for dirty money, as they announced themselves.

Danske Bank (15.3 billion Danish kroner): Danske Bank Announcement – Involved in a large-scale money laundering scandal through its Estonian branch.

Societe Generale

Societe Generale didn’t escape the watchful eyes of the U.S., fined $1.4 billion, as JD Supra notes. Their game? Sidestepping sanctions, indulging in financial indiscretions.

Societe Generale ($1.4 billion): JD Supra – Fined for violating U.S. sanctions and engaging in financial crimes.

Commerzbank

Commerzbank joins this hall of infamy with a $1.45 billion penalty. Their indiscretion? Transacting with sanctioned states like Iran and Sudan, a dance with the devil that cost them dearly.

Commerzbank ($1.45 billion): Justice Department – Penalized for sanctions and Bank Secrecy Act violations, particularly for transactions with Iran and Sudan.

Standard Chartered

Standard Chartered, once a paragon of the industry, stumbled with a $1.1 billion fine. The Guardian highlights their porous anti-money laundering controls, a sieve that let through sanctioned funds.

Standard Chartered ($1.1 billion): The Guardian – Fined for poor anti-money laundering controls and breaching sanctions against countries like Iran.

ING Groep

ING Groep’s ~$900 million penalty, as reported by The Globe and Mail, underscores a simple truth: prevent money laundering, or pay the piper.

ING Groep (~$900 million): The Globe and Mail – Penalized for failing to prevent money laundering activities within its system.

JP Morgan Chase

And lastly, JP Morgan Chase, fined $920 million for rigging the precious metals and U.S. Treasuries markets. A costly reminder from the Justice Department that even the mightiest can fall.

JP Morgan Chase ($920 million): Justice Department – Fined for manipulative trading practices in precious metals and U.S. Treasuries markets.

Next Episode

Stay tuned for our next episode, where we slice deeper into the layers of money laundering. Until then, keep a keen eye on your wealth and a sharper mind on its origins. Thank you for joining us. If you’re intrigued by the clandestine history of money laundering and wish to unravel more, visit us at anti-money-laundering.eu.

Remember, knowledge is the best defense against the dark arts of financial crimes.

„Debunk the Junk“ is brought to you by Leitner & Associates, your beacon in the GRC landscape. For more insightful discussions and historical dives, subscribe and share. Until next time, keep debunking the junk.