Contents

Debunk the Junk

Welcome to „Debunk the Junk,“ the podcast that slices through the layers of financial deception to unveil the core of illicit activities.

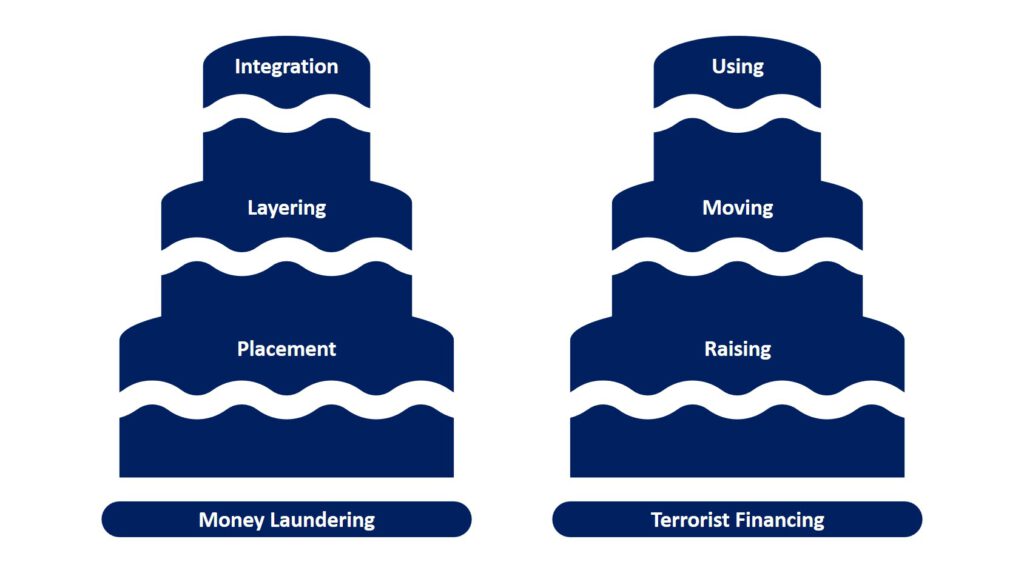

Two Cakes

Money Laundering

- Placement – Represented by the largest bottom layer, indicating the stage where the largest volume of illicit funds enters the financial system.

- Layering – Depicted as a smaller middle layer, suggesting that, during this stage, some of the money might be lost due to various transactions and fees.

- Integration – Shown as the smallest top layer, symbolizing that the amount of money finally integrated into the legitimate economy might be less due to the laundering process.

Terrorist Financing

- Raising – The large bottom layer represents the initial accumulation of funds, which is typically the largest bulk of resources gathered for terrorist activities.

- Moving – The middle layer is smaller, illustrating that moving funds can incur losses due to the costs and risks of transferring money clandestinely.

- Using – The top and smallest layer indicates that the amount of money actually used for terrorist acts may be less than what was initially raised, reflecting potential losses or expenditures along the way.

One Knife

Slice Through the Layers of Financial Deception. Uncover the truth with ‚Debunk the Junk,‘ as we dissect the complex world of money laundering and terrorist financing. From the initial Placement to final Integration, and from Raising to Using funds, we cut deep, revealing what remains after the financial facade falls away. Join us, where every slice exposes reality.

Leitner & Associates

Before we begin today’s episode of ‚Debunk the Junk,‘ we’d like to take a moment to thank our sponsor who make this podcast possible.

Specializing in Governance, Risk, and Compliance (GRC), Leitner & Associates is a boutique consultancy dedicated to helping organizations navigate complex regulatory landscapes. Their expertise in GRC ensures that businesses can operate with integrity and efficiency. Discover more about their holistic solutions and comprehensive products at leitnerassociates.com.

Episode 1: The history of Money Laundering

Ancient China

Today, we embark on a historical journey to trace the roots of an activity as old as civilization itself: money laundering. Our story begins in Ancient China, around 2000 BCE. Picture bustling markets and grand caravans, but amidst this economic vibrancy, stringent controls by ruling dynasties. Their grip on commerce was iron-tight, seeking to monopolize the economy and control capital outflow. But the human spirit craves freedom, especially in trade. Wealthy merchants, stifled by these restrictions, began to weave the first threads of what we would call money laundering. They employed intermediaries and covert trade routes, smuggling their wealth into lands where trade was not a chain but a liberating wind.

Prohibition and Al Capone

Fast forward to the United States, 1920. Prohibition casts a long shadow over the land. Alcohol, though outlawed, flows through an underground river of demand, directed by organized crime syndicates. Here, we see the modern form of money laundering take shape – dirty money in dire need of a wash. Al Capone, a figure so infamous, his very name evokes images of crime and cunning. While Capone’s empire necessitated money laundering, he is mistakenly credited with its origin. The tales of laundromats churning dirty cash into clean are compelling but, let us be clear, more fiction than fact.

War on drugs

The term „money laundering“ wouldn’t seep into our lexicon until the 1980s, amidst the United States‘ war on drugs. A time of cartels and kingpins, when the sheer volume of drug money demanded a system to cleanse the cash without alerting the law. It was then that the U.S. government unsheathed its legislative sword. The Money Laundering Control Act of 1986 declared the act a crime in itself, birthed „structuring“ laws, and marked a new era of financial scrutiny. As we reach the close of this episode, remember that the FATF and modern regulations stand as sentinels against this ancient practice. Yet, the game of cat and mouse continues, ever-evolving.

Next Episode

This has been „Debunk the Junk.“ Stay tuned for our next episode, where we slice deeper into the layers of money laundering. Until then, keep a keen eye on your wealth and a sharper mind on its origins. Thank you for joining us. If you’re intrigued by the clandestine history of money laundering and wish to unravel more, visit us at anti-money-laundering.eu.

Remember, knowledge is the best defense against the dark arts of financial crimes.

„Debunk the Junk“ is brought to you by Leitner & Associates, your beacon in the GRC landscape. For more insightful discussions and historical dives, subscribe and share. Until next time, keep debunking the junk.