Contents

3 Lines of Defense (LoD) in AML/CTF

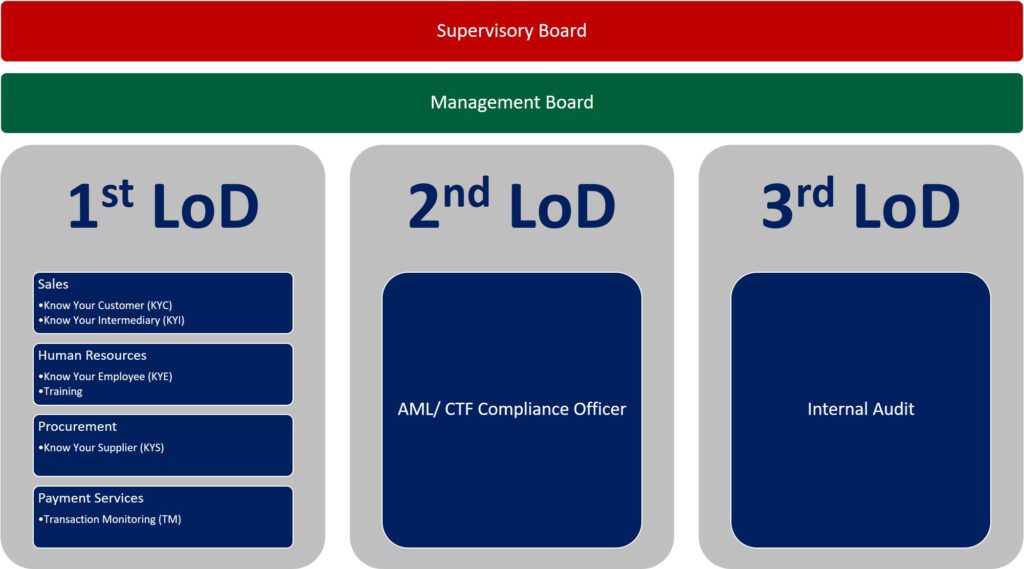

The 3 Lines of Defense (LoD) model serves as a cornerstone of an effective Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance program. By delineating clear roles and responsibilities across various departments and levels within an organization, the 3 LoD framework ensures a robust and comprehensive approach to risk management.

First Line of Defense: The Frontline Gatekeepers

The first line of defense is where the rubber meets the road. It involves the front-line employees who deal directly with clients and carry out the business’s daily operations. They are the initial gatekeepers, tasked with implementing AML/CTF policies through customer due diligence (Know Your Customer – KYC), ongoing monitoring of transactions, and adherence to regulatory requirements. Sales teams, customer service representatives, and payment processors form the backbone of this line, vigilantly identifying and reporting suspicious activities.

Second Line of Defense: The Compliance Custodians

The second line of defense is embodied by the AML/CTF Compliance Officer and their team. This strategic echelon oversees the implementation of the compliance program and ensures that the first line’s controls are functioning as intended. They are responsible for policy development, risk assessment, and training programs that reinforce the organization’s compliance posture. The second line also serves as a pivotal liaison, interpreting regulatory landscapes and translating them into actionable policies and procedures.

Third Line of Defense: The Independent Auditors

The third line of defense is the realm of Internal Audit. This independent body assesses the effectiveness of both the first and second lines of defense in managing AML/CTF risks. With a high level of autonomy, Internal Audit provides objective evaluations and assurances to the organization’s senior management and supervisory board. They scrutinize the controls in place, identify any gaps in the risk management framework, and recommend enhancements to fortify the overall compliance structure.

Understanding and implementing the Three Lines of Defense in AML/CTF is crucial for any organization looking to maintain compliance, prevent financial crime, and operate with integrity in today’s global economy. By fostering a culture of compliance and vigilance, the 3 LoD model stands as a testament to an organization’s commitment to lawful and ethical business practices.

1st Line of Defense (1st LoD): Operational Controls

The first line of defense is the front-line staff who are responsible for managing risks as part of their day-to-day activities. In the context of AML/CTF, this includes:

- Sales:

- Know Your Customer (KYC): Implementing due diligence processes to verify the identity of customers and assess their risk profiles.

- Know Your Intermediary (KYI): Vetting intermediaries to prevent the organization from being used for money laundering through third parties.

- Human Resources (HR):

- Know Your Employee (KYE): Screening employees to ensure they are fit and proper, and to prevent insider threats.

- Training: Providing regular AML/CTF training to staff to keep them aware of compliance requirements and how to recognize red flags.

- Procurement:

- Know Your Supplier (KYS): Conducting due diligence on suppliers to mitigate the risk of money laundering through the supply chain.

- Payment Services:

- Transaction Monitoring (TM): Monitoring financial transactions for suspicious activity and reporting as necessary.

2nd Line of Defense (2nd LoD): Risk Management and Compliance

The second line of defense oversees the effectiveness of the first line and ensures compliance with laws and regulations:

- AML/CTF Compliance Officer: Responsible for developing and overseeing the AML/CTF System, policy development, ongoing risk assessments, monitoring compliance with AML/CTF regulations, and reporting to regulatory bodies.

3rd Line of Defense (3rd LoD): Independent Assurance

The third line of defense provides independent assurance that the first two lines are functioning effectively:

- Internal Audit: Carries out independent evaluations of the organization’s controls, risk management, and governance processes related to AML/CTF. The audit aims to provide objective assurance and recommendations for improvement.

In essence, the 3 LoD in AML/CTF ensures that responsibilities for preventing, detecting, and reporting money laundering and terrorist financing are clearly defined and that there are checks and balances in place to protect the integrity of the financial system.

Sources:

- The IIA’s Three Lines Model: An update of the Three Lines of Defense https://www.theiia.org/en/content/position-papers/2020/the-iias-three-lines-model-an-update-of-the-three-lines-of-defense/

- Directive (EU) 2015/849 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32015L0849

- German Anti-Money Laundering Act (Geldwäschegesetz – GwG) https://www.bafin.de/SharedDocs/Downloads/EN/Aufsichtsrecht/dl_gwg_en.html